Posts by Claudenougat:

-

Prime Minister Cameron immediately announces his resignation: from the New York Times and British papers, see here A political crisis is Brexit’s first consequence on the UK.

-

In a historic vote, Britain votes to leave the European Union: from the New York Times, see here. With only a few towns left to report, the BBC “called the race for the Leave campaign shortly before 4:45 a.m. [local time], with 13.1 million votes having been counted in favor of leaving and 12.2 million in favor of remaining.”

-

With 38 results left to declare, Britain faces the real possibility of a Brexit as Leave has 51.8 percent of the votes counted so far: from the Guardian, see here. The pound has dropped to its lowest levels since 1985 and a selloff is predicted once the market opens. Japan’s Nikkei index has slumped 7 percent, this being its worst one-day fall since Fukushima was hit by an earthquake that resulted in a tsunami and a nuclear disaster.

-

333 results left to declare: from the BBC, see here. Leave has 50.3 percent of the vote so far. Brexit may seem closer than thought.

-

Close to two and a half hours after polls have closed, Sterling fell 2.8 percent (12:21 a.m. local time): from Bloomberg, see here. Earlier it had climbed above $1.50 for the first time since December after a YouGov survey.

-

The first five districts have declared (of 382): from the Evening Standard, see here. Four districts have chosen to remain (Clackmannanshire, Orkney Islands, Newcastle, Gibraltar) while one, (Sunderland) has supported Brexit overwhelmingly.

-

Shortly after closing, early polls show Remain (barely) winning, a YouGov poll putting Remain at 52% vs. 48% and reassuring the markets: from Business Insider, see here. It is however too early to be sure (2 hours after closing time), when the markets open in Asia, more will be known…

-

Global stocks climb with “voting underway in the U.K.’s referendum on its membership in the European Union”: from Bloomberg, see here.

-

Polls suggest the debate is “neck-and-neck”: from the Telegraph, see here. The Ipsos MORI survey displays 52 percent advocating to remain in the E.U., against 48 per cent for a Brexit.

-

Earliest results not before 11 pm, local time: from the Wall Street Journal, see here.

-

Brexit referendum looks like the Scotland independence plebiscite, and Mr. Cameron has failed to learn the lessons from it, that “referendums settle nothing”: from the Financial Times, see here. Worries about the economy may be enough to let the Remain camp win, but FT’s Mure Dickie argues that “the most important lesson from Scotland, however, was the naivety of expecting a referendum to take the sting out of a long-running political debate.”

-

Phone polls suggest the result could go either way: from the Telegraph, see here. Since last year, phone polls suggest a nine per cent lead for Remain, while online polls have it at just one per cent. And now sitting at 51 to remain vs. 49 to leave (based on average of last 6 polls).

-

Global stocks rallied along with the British pound as referendum started: from the Wall Street Journal, see here. The financial world is sanguine, convinced the Remain camp will win.

-

Polls are open, a record 46,499,537 people are entitled to take part: from the BBC , see here.

-

European Commission President Jean Claude Junker says “out is out”, there will be no deal to renegotiate: from the Independent, see here. This is a blow to those Britons who hoped that negotiations would always be in the cards.

-

A UK vote to leave Europe would “shake the continent to its foundation”: from the Wall Street Journal, see here. No matter the outcome, the EU will never be the same again. The UK’s “effort to claw back power from Brussels” which is what Prime Minister Cameron did before calling for the referendum in February 2016, is an “approach that other European politicians are promising to follow, potentially fragmenting the bloc further”. Hungary’s Prime Minister Viktor Orban is particularly tempted – as are all the populist parties on the right, stirring fears of refugees – and Orban has called for a referendum on the EU’s migration in September. If the UK leaves, expect referendums for leaving the EU in both France (with Marine Le Pen’s National Front) and the Netherlands (with Geert Wilder’s Party for Freedom). On the other hand, former French President Sarkozy, who is seeking to return into politics, is pushing for strengthening the “core” of Europe, i.e. the 19 members using the Euro, the Eurozone, with setting up a European Monetary fund and a Eurozone finance minister. But deepening the EU federal features is not in the cards as both Germany and France have elections coming up and politicians fear a backlash from populists.

-

No matter the vote outcome, the EU needs to rethink itself: from the New York Times, see here. It must address its “democracy deficit”, something that has been noted for a long time yet nothing has been done.

-

Push to leave EU lost its steam in the last two days: from abc news, see here. The senseless murder of Labor member of Parliament Jo Cox by a deranged individual screaming “Britain first!” certainly contributed to this result. Whether this effect is permanent, we shall see today.

- a form of European banking union, with perhaps as a first step a European Bank Deposit Insurance scheme to stem capital flight;

- a functioning bailout fund, strengthening the already approved European Stability Mechanism so that it is capable of providing sufficient financial support to the eurozone banking system;

- Eurozone-wide supervision and regulation.

- governments are progressively losing control over their tax revenues: it becomes ever easier for big, global corporations and the ultra-rich to escape taxation. To illustrate, two examples will suffice: the Greek shipping industry is not taxed by the government, the theory being that if shipping magnates were taxed, they’d move elsewhere, hence it’s useless to even attempt to tax them. General Electric, the American corporate giant, has over one thousand staff dedicated to exploiting tax loopholes with the result that GE pays one of the lowest corporate taxes in America: last year, despite $14.2 billion in worldwide profits including more than $5 billion from U.S. operations, GE did not owe the US Government any taxes in 2010;

- competitiveness in the industrial sector is threatened by emerging economies (the BRICS) and outsourcing is eliminating jobs, particularly in manufacturing, causing increasing unemployment;

- the IT sector and other advanced technologies such a green energy have not so far created enough jobs to cover the losses in industry; as a result, unemployment is not only sticky, it has grown especially large for new entrants in the labor market, in particular the young.

Brexit Opinion Tracker

June 28th, 2016By Claude Forthomme.

Note to our readers: This is a new kind of article, bringing you opinions and political views of influencers and politicians as events unfold.

Today, we are covering Brexit, the referendum calling on the British to vote for leaving or remaining in the European Union– the vote will go on until 10 pm today (local time). The article will be updated throughout the day and until tomorrow when results will be announced; we plan to provide comments and links to the more notable articles from all major news media, in real time, the most recent first, as they are uploaded onto Thingser – a social media platform dedicated to following trends and news, with members constantly uploading noteworthy articles and sharing them with like-minded friends. And here, the Impakter team will share those news as they develop with you – be sure to come back for our wrap-up note and assessment once the vote is known. For those interested, an in-depth analysis of Brexit, the pros and cons, was published on Impakter on 1 June, see here.

Wrap-Up Note: The Brexit Dream Likely to Turn into a Nightmare

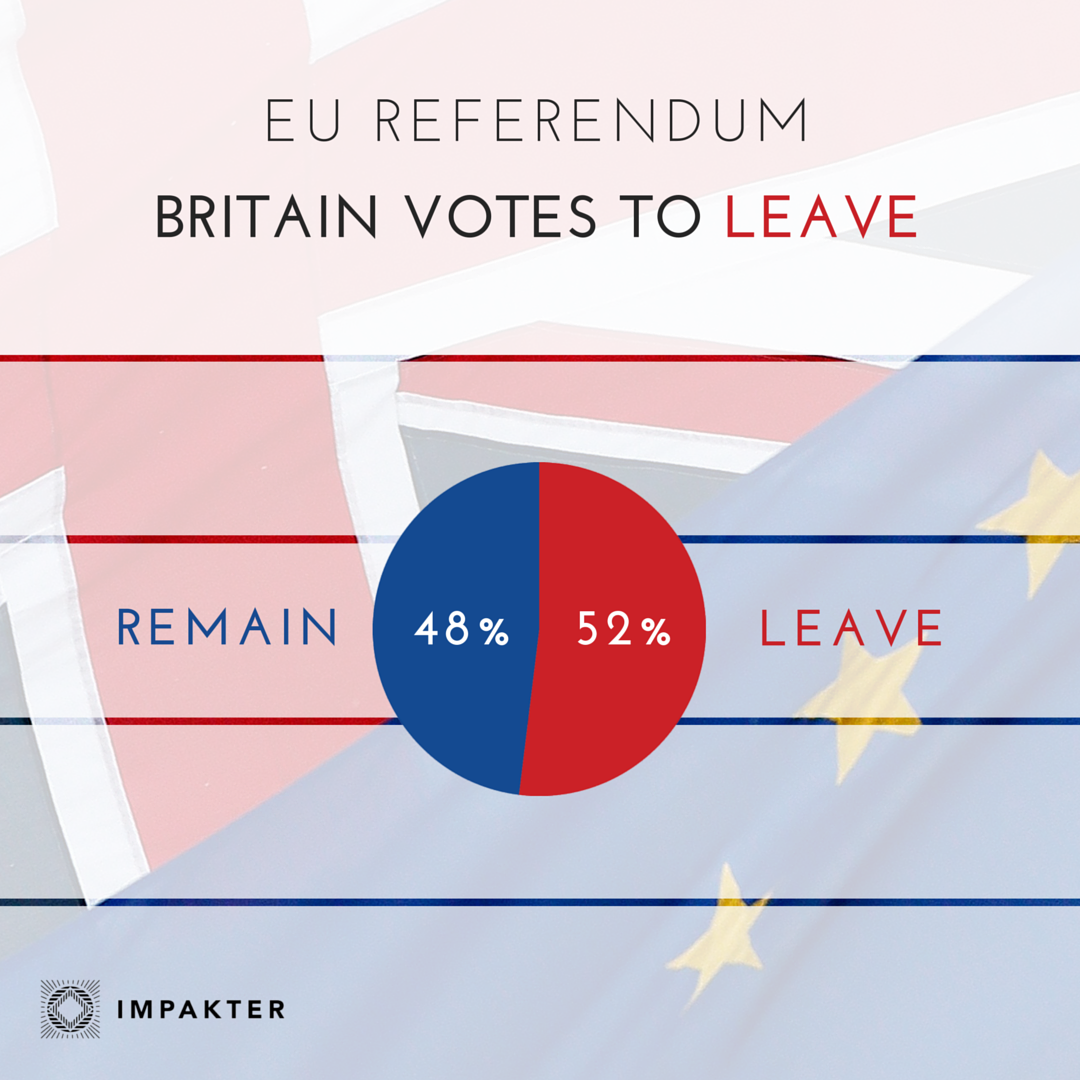

While the vote on 23 June was carried out with quiet and dignity, as exit polls were (wisely) banned which contributed to the maintenance of order, the outcome is stunning: 52% for leaving the EU, over 17 million voters, against 15.9 million for the Remain camp.

UKIP’s secretary Nigel Farage exulted, ““Dare to dream that the dawn is breaking on an independent United Kingdom.” Unfortunately, that dream could quickly turn into a nightmare as the predictions of a deep economic downturn become real.

And the downturn has already started. Prime Minister Cameron immediately announced his resignation, opening up a government crisis in the UK.

Shock waves hit the EU as well. A quick reaction came from Martin Schulz, the president of the European Parliament, who said the assembly would hold an emergency session on Tuesday to address Brexit. The European Council President Donald Tusk also announced the 27 EU bloc is “determined to keep our unity” and will assess a course of action “to avoid a chain reaction” (as Martin Schulz put it) in a EU summit meeting next week – or at least on the margins of it, as he plans to schedule meetings with EU leaders without Prime Minister Cameron.

When markets opened in Asia on the morning after (24 June), stock prices plummeted, along with the British pound. In a way, this is surprising, financial markets are rarely wrong and they had bet on the Remain camp, yet, this time, they turned out to be quite wrong. Markets had, it seemed, not given sufficient weight to the emotions the Leave campaign had stirred up in the British population, playing on fears of immigration.

So, Brexit was in the cards and to the end it was a very close call, with the 52-48 ratio seemingly reversed at first, in the early hours after the polls had closed, in favor of Remain.

Yet, sadly, the murder last week of Jo Cox (41), mother of two, a Labour politician who strongly supported Remain, did not change the cards.

Immigration was the biggest ISSUE in the campaign

The biggest issue aside from xenophobia, nativism and even racism as we have seen from UKIP members. Objectively, with net migration to Britain of 330,000 people in 2015, more than half of them coming from the European Union, there was little Mr. Cameron could do. And, as argued again and again, while immigrants contributed more to the economy and to tax receipts than they cost, many Brits felt that their “national identity was under assault and that the influx was putting substantial pressure on schools, health care and housing.”

The real problem is that the European project, instead of being seen as a solution to war and poverty intended to ensure prosperity and security, is seen as a threat to “national identity”.

An extraordinary large number of people, about half the UK population, is unable to go beyond nationalism which for them, is a major psychological crutch shoring up their sense of belonging. Bottom line, over 13 million Brits feel they belong to Britain, not to Europe – and most of them are in England (85 million of the UK population is English), not Scotland or Northern Ireland. And that’s why you can expect independence movements in both place to have a second wind in their sails, as Scotland and Northern Ireland may very well opt out of the UK in order to stay inside the EU’s single market.

As the NYT Steven Erlanger put it, “The victory of the Leave campaign and Britain’s exit from the European Union risks making Britain a poorer place, if the pre-referendum economic forecasts prove true”.

The break-up is going to be messy.

How to leave the European Union is not easy, and the one article permitting it (article 50), leaves many moot points in the process, except for setting a clear deadline: 2 years from the moment a country officially requests to leave. In the meantime, nothing changes, everything stays in place as before the vote. So the first hurdle the British government will need to clear is when to ask the EU to leave – some in the Leave camp would like Cameron to delay the request in order to gain leeway in early “pre-leaving” negotiations with the EU.

This overlooks that the EU, especially France and Germany, will not be lenient on a country leaving, out of fear of a domino effect. They will want to make it very tough on the UK in order to deter others from leaving. And as Greece has learned at its expense, Germany can be very tough indeed.

And rightly so: Brexit resonates far beyond Britain. There is an astonishing number of people across Europe who think like the Brexit fans. In the latest Eurobarometer survey, covering all 28 EU member states, 45 percent of respondents said they think that the EU is going in the wrong direction, compared with only 23 percent who think the opposite. The European project has never been so shaky.

So what happens next?

The EU will hurt

“The main impact will be massive disorder in the E.U. system for the next two years,” said Thierry de Montbrial, founder and executive chairman of the French Institute of International Relations. “There will be huge political transition costs, on how to solve the British exit, and the risk of a domino effect or bank run from other countries that think of leaving.”

Domino effect or bank run risk: yes, especially with the new East European members, in particular Poland and Hungary – but also Austria. This will give a boost to rightist populist parties across the continent, in France, to Marine Le Pen’s Front National, in the Netherlands, to Geert Wilder’s Party for Freedom, in Germany to the Alternative for Germany.

Europe will have to “reorganize itself in a system of different degrees of association,” said Karl Kaiser, a Harvard professor and former director of the German Council on Foreign Relations. “Europe does have an interest in keeping Britain in the single market, if possible, and in an ad hoc security relationship.” Different degrees of association: yes, definitely. Expect – if all goes well and European politicians start acting as leaders rather than puppets – that the 19 members of the Eurozone could become the core of a new Europe. Former French President Sarkozy (who is thinking of going back into politics) has talked of setting up a European Monetary Fund and installing a European Finance Minister for the Euro.

But give the UK access in the single market? Probably not.

Cameron had promised he would ask for exit immediately after a vote showing that’s what the people wanted, but having announced he is resigning, he is effectively handing over that decision to his successor.

Britain is Isolated

While the EU is hurt – but still whole with 27 members -, Britain will now find that it is “dangerously isolated”. You can’t turn back the clock on globalization.

As a prescient article by Brookings Institute’s fellow Arturo Sarukhan warned, Brexit will have an effect even on America: it is “like manna from heaven for an isolationist and nationalist like presumptive Republican presidential nominee Donald Trump”. Also the treaty currently under negotiation, the Transatlantic Trade and Investment Partnership (TTIP) meant to open up trade between the US and Europe, is likely to hit the rocks without the UK’s participation.

On a political level, the US will soon find that the UK, its “special friend”, no longer has the clout it used to have now that it is out of the EU. And the US-UK long-standing special partnership could be seriously dented and possibly replaced by a US-Germany special relationship.

One may well wonder whether that is what even the most convinced British nationalist really wanted…Because the times when Britannia Rules the Waves are really over.

Final Views (24 June):

Today’s views (23 June):

Yesterday’s views (22 June):

Comments Off on Brexit Opinion Tracker

Is the UK Headed for Exit from the European Union?

February 4th, 2013By Claude Nougat.

Cameron’s discourse yesterday announcing that he will seek to renegotiate the European Treaties with a view to make them more “flexible” – read: in line with UK national interests – is something close to political blackmail. He claims he believes in Europe, but who can believe him?

I shall just post two lines here to indicate my ownreaction as a European citizen committed to thecreation of a European Union.

One, I’m horrified at the chauvinistic, nationalistic tone: he and his Conservative Party are straight out of the darkest pseudo-patriotic years of European History. This denial of European values is the kind of mentality that has caused the two World Wars. As long as Britannia Rules the Waves for the British, Europe has no chance.

A real throwback to a darker age.

The UK wants access to the lucrative European market (500 million people!) but will not give up anything in return to get access.

It’s all take and no give.

This attitude is all the more remarkable that if the UK persists and a referendum is set up on the simple question, as Cameron put it, of an in/out option, and the British Euro-skeptics win – well, it will be Britain itself that will hurt the most, in particular the City…

Two, this seriously raises the question whether the UK has any right to stay in the EU. The experience so far with British membership has not been encouraging, to say the least. The UK has always acted as a break whenever there was a need to move forward.

Indeed, the UK’s geopolitical allegiances are Atlantic, not European: the UK feels closer to the United States (same language, same culture) than to Germany or France even though they are next door neighbors. Undoubtedly the combined result of History and Geography: after all the UK is an island and it has a tendency to drift away from the continent…Historically, British diplomacy has always focused on pitting one European country against the other as a way to preserve its own freedom and integrity.

Moreover, at the practical level of the Brussels secretariat, the British are already disengaging themselves: an ever dwindling number of young Brits join the European bureaucracy, they just don’t see it as a career for themselves. Politically too, the UK has operated on a downward spiral with its European partners and is no longer able to obtain important positions within theEuropean Commission. At the moment, the highest position held by a Brit is CatherineAshton‘s as the “High Representative of the Union for Foreign Affairs and Security Policy” – a mouthful to say that she should act as the EU’s Foreign Affairs Minister…but in fact, she stilldoesn’t. She is constantly relegated in the background. The last time we heard of her was when she made a statement on Gaza in November 2012…

Your opinion? Should the UK opt in or out? And if by chance it stays in, is there hope that it will be finally committed to building Europe?

What Is Causing the Euro Crisis: A Financial Mess, Cultural Diversity or Globalization?

July 4th, 2012By Claude Nougat.

We all know how the Euro crisis began: with Greece and lies about its public deficit. Then over the next two and a half years, the drama expanded to include Portugal, Ireland, Italy and Spain. Now the Spanish banking system threatens to collapse and take with it the Euro. But what is really causing the Euro crisis?

Is it “just” a problem of sovereign debt and speculative attacks fed by the bond markets conviction that the Euro is not defended by credible institutions and financial power the way the US dollar is? Or are other factors at work here, in particular cultural divergences and globalization?

Let’s take them in turn.

1. Financial Factors

On June 2nd 2012, Soros, in a memorable and much-discussed speech in Trento (Italy) has made the point that Angela Merkel is responsible for the way the crisis has unfolded: she put a stop to Germany in its traditional role as the engine of a federated Europe. How did she do this? It seems that after the fall of Lehman Brothers in 2008 she declared that “the virtual guarantee extended to other financial institutions should come from each country acting separately, not by Europe acting jointly. (italics added)”

Bizarre as it may seem, if you read Soros’ speech as presented now on his website you won’t find this particular reference to Ms. Merkel’s declaration – undoubtedly taken down under diplomatic pressure. Mr. Soros may have cleaned up his speech to please the Germans but the fact remains that if Ms. Merkel and Germany had moved immediately to quell the speculative attacks on Greece, we would not have a Euro crisis now.

Mr. Soros made two further important points: we have just three months to stem the Euro crisis before it destroys the European Union and only the Germans can do it. This three month’s window is a consequence of the next government election in Greece (June 17): one may expect the Greeks to be ready to accept the bailout agreement but unable to meet the conditions. So the crisis will come to a climax in the fall just when the German economy will be weakening as its major exports markets slow down. Under the circumstances, “Chancellor Merkel will find it even more difficult than today to persuade the German public to accept any additional European responsibilities.”

How did we get into this situation? Because the Maastricht Treaty created a common currency without prior political union: it took a step that was too big to be sustainable. As long the economic winds were favorable, the instability was not perceived. The common currency threw together countries at very different levels of development: for Germany, i.e. “the center” that includes other northern European countries like Finland or the Netherlands, the Euro was an opportunity to expand exports. The Euro was cheaper than the national currencies had been and all the necessary measures to improve competitiveness were taken, chief among them restraint on salary increases. For Southern European economies, i.e. “the periphery”, the Euro became a source of cheap credit feeding a dangerous consumption and housing boom. Commercial banks, allowed to accumulate government bonds without having to set aside equity capital, gobbled up bonds of the weaker euro members to make an extra profit.

When the 2008 Wall Street crash came, European governments engaged in massive deficit spending and the “periphery” found itself in the position of a third world country that has become heavily indebted in a currency that it does not control. Financial markets discovered that such government debt was no longer sovereign. Banks loaded with these bonds found themselves insolvent. Result: a closely interlinked banking and sovereign debt crisis.

In the spring of 2012 the Bundesbank, with claims of some 660 billion euros against the central banks of the Eurozone periphery, began to shed them off, in order to limit the losses it would sustain in case of a Eurozone breakup. Furthermore, it has always been against expanding the money supply or adopting any financial fix, most notably Euro-bonds, even though they would be an instant solution. Why? Because since the Bundesbank is in the driver seat, it would find itself having to guarantee them.

This is a self-fulfilling prophecy: once the Bundesbank does it, all banks do it. They are reordering their exposure along national lines: the “center” is shedding bonds from the “periphery” and conversely there’s a capital flight from the periphery towards the stronger Euro countries. Towards Germany in primis – indeed German bond yields are near zero! As a result, credit to enterprises, especially the medium and small ones that are a major source of employment, becomes less available and unemployment soars in the periphery.

Hence a deeper crisis. A wider divergence between Germany and the rest of the Eurozone. Moreover, an orderly break-up is not in the cards because the current re-ordering of Euro financial exposure within national boundaries is not completed (it would take several years).

Yet those who would suffer the most from the break-up would be the Germans themselves. They’ve benefited the most from the Euro so far – a cheap Euro has been the source of Germany’s success in exports – but a restoration of the Deutschmark would be very painful since it would be valued much higher than the Euro ever was.

By end June, a European Summit should come up with proposals to avoid a Euro break up. So far, it appears that the following financial measures are under discussion:

It is probable that Germany will do whatever is needed to preserve the Euro but no more, allowing the internal divergences between the center and periphery to grow, thus preventing the European Union of ever achieving a federal union like the United States.

What is needed is to convince the Germans to do more? For a real political change, Ms. Merkel will need to leave and that won’t happen before 2013. Only then, and assuming a more pro-Europe party emerges, might Germany be more amenable to sustain the Euro and solve the euro management problems.

Problem solved? Not if some other negative factors are at work in Europe, in particular on the social/cultural front.

2. Cultural Factors

Cultural divergences could well be the forces that will overturn the boat.

Some researchers and most recently NYT columnist David Brooks (see his excellent article here ) have argued that the European union project makes no historical sense in the face of deep-set cultural divergences. Brooks reminds us how the world, after the disasters of World War II, yearned for peace and harmony: it was in this favorable setting that multicultural and supranational entities like the United Nations were created and with it all the international organizations still with us, chief among them the World Bank and the IMF. Those were also the years of the birth of the European Union project that began with the creation of the Coal and Steel Community, an optimistic effort by Germany and France to bridge their differences and “never” go to war against each other again.

Now, the pendulum has swung the other way: cultural divergences are increasing, not diminishing. There is a “failure of convergence” not just between countries but also within countries.

Consider the United States: a single country with a single currency, but as Brooks points out: “the country has become more polarized, not less. The country has become more difficult to govern, not less.” This is why the 21st century will be, as he puts it, “the segmentation century”. With the rise of modern communication technologies and Internet, “people’s tastes have become more parochial, not less.”

Brooks argues convincingly that the failure of convergence is most striking in Europe. While “a tiny sliver of European society”, as he puts it, is becoming more transnational, only “only 2 percent of Europeans live in a different European nation than their country of citizenship.” Habits, values and opinions differ from country to country. For example, 40% of Danes believe that work is a “very important” part of their lives, compared with roughly 65 percent of the French. According to Pew Research surveys, 73 percent of Germans think that economic conditions are good right now. In France, 19 percent think that, and in Spain only 6 percent. Europe means different things to different people. There is not even an understanding that Germans are closer to Greeks than they are to Chinese or Iranians.

Add to that the fact that there’s been a resurgence of local regionalism: the Basques in Spain, the Flemish-Walloon rift in Belgium, the Lombards’ Northern League in Italy etc. Not to mention the remarkable success of nationalistic, anti-immigrant parties like Marine Le Pen’s Front National in France, a veritable throwback to 19th century chauvinism.

In this environment, it should come as no surprise that the European Union project has a hard time surviving…

To make matters worse, there is another negative factor at work here, the one which underlies the other two: globalization.

3. The Impact of Globalization

Over the past decade, globalization has progressively impacted developed countries, and in particular the Eurozone, in the following ways:

Conclusion: Quo Vadis Europe, Can you Reform?

This is the general backdrop against which the Euro drama is unfolding: a financial mess, cultural diversity and globalization. Which means that even if a “financial fix” is found to shore up the Euro, the long term downward economic trends due to globalization will continue as Eurozone governments find it hard to raise adequate revenues; as European industry finds it hard to compete with cheap imports produced in the BRICS; as the loss of jobs in manufacturing is not compensated by gains in other newer sectors.

Over time, this means the Eurozone as a whole is growing poorer (even if the Germans still feel rich!) And obviously less able to afford its expensive welfare system. Austerity is the catchword. Cuts into pensions and health care benefits appear inevitable. The alternative is to make the management of the welfare system more efficient. But that implies reforming the state bureaucracy, cutting out red tape and unnecessary duplicative jobs, streamlining management processes, suppressing clientelism etc. This concerns in particular the euro “periphery” though even the “center” is not immune to the need for administrative reform.

Are Europeans even capable of reform? The Germans demand it. But will the cultural divergences stop reform in its tracks? Very possibly. People in the periphery are already rebelling against austerity: from there it’s but a small step to rebel against any kind of reform, however much needed.

The only way to move forward would be to believe once again in something BIGGER: the “fantastic project” of the European Union, as Mr. Soros calls it. You need dreams to overcome the grim reality of chauvinistic retrenchment, each country behind its own borders.

Is the European dream dead? Can it be revived? What is surely lacking in Europe is a leader with a European vision. Ms. Merkel often talks about wanting “more Europe” but she doesn’t seem to be aware that time has run out on her. The Euro financial mess has to be fixed now and cannot wait the decades necessary to overcome cultural divergences and achieve reform, step by step the way Ms. Merkel wants to do it.

What is needed is a European leader with the courage to push for European federation now. Someone charismatic.

Can Mr. Hollande, the new French President do it? Can he be considered charismatic? I doubt it. Certainly his heart is in the right place: he talks about the need for growth and that is a step in the right direction. But it doesn’t address the fundamental issue, which is a lack of European cooperation.

Europeans need to understand that they are in this together because they’ve adopted a single currency. Now they need to take that final step and complete the process to sustain the Euro.

If not, the Euro will drop dead, and Europe with it. The tsunami will be enormous, the shock waves will hit the American continent as well as the BRICS. It is in everyone’s interest to see Europe solve its Euro problem.

Claude Nougat is an economist (Columbia U. graduate) and United Nations veteran (25 years in FAO; ended careeras Regional Representative for Europe and Central Asia). She has been regularly writing about the Euro crisis on her blog at http://claudenougat.blogspot.com

Article Source: http://EzineArticles.com/7129971