Posts by DeborahWeir:

- Abundant cash

- Regime-changing technology

- Limited government regulation

Deborah Weir market analysis

May 17th, 2014By Deborah Weir.

Headlines scream global unrest and hint at war. The stock market is weak and confidence indicators are poor. Don’t they know that war, as terrible as it is, stimulates the economy?

Look at the graphs of GDP during wartime from chapter 19 in Timing the Market.

No one wants war; but investors are misinterpreting the economic effects of war.

2) One of the most successful banks in the U.S. is the Federal Reserve. The securities that it bought during the financial crisis, among other investments, are paying off.

The Fed paid an estimated $77.7 billion to the Treasury Department last year according to a news release on its website http://www.federalreserve.gov/newsevents/press/other/20140110a.htm

While this payment is less than that in 2012, the Fed has transferred funds to the Treasury every year since 1934.

3) Good news from the banks could boost the equities market.

That foundation of the banking system, commercial and industrial loans, increased at an annualized rate of 26.4% last February according to a Federal Reserve report.

Most of the data has improved – including real estate loans on line 11. Banks seem to be responding to increased business activity.

Comments Off on Deborah Weir market analysis

Can This Stock Market Rally Last?

December 6th, 2013By Deborah Weir.

As this bull market approaches its fifth birthday next March, some investors are worried about its sustainability. Their concerns may be unfounded.

Some analysts think that there are three conditions required for an extended bull stock market:

The first two conditions are so strong that they may be enough to overcome the unsettled regulatory environment. We will examine the cash available for investment and the new technology that will attract cash into the stock market.

Most investors know that cash is abundant. The Federal Reserve has been adding $85 billion a month to our money supply, and the proposed new Fed chair may continue that effort.

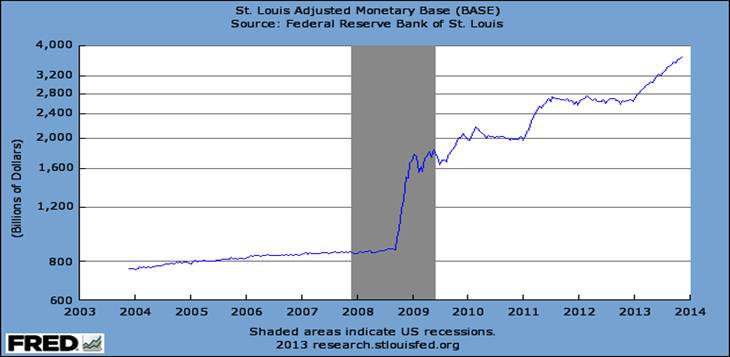

The monetary base quadrupled from a little over $800 billion to $3600 billion during the last six years. A lot of money is on the sidelines available for investment. Interest rates are near historic lows, so investors are looking for alternatives to fixed-income – in equities.

Individual investors are considering the stock market as a source of higher yields than those available in the bond market. But there is another force at work.

A new technology is forcing creative destruction on our economy. Horizontal drilling for oil and gas is replacing traditional vertical drilling according to the energy consulting firm, IHS Cara. The U.S. is opening up major sources of new, inexpensive energy. We now have the cheapest energy in the world according to a Wall St. Journal article on Oct. 5, 2013 by Keith Johnson. Our natural gas costs about a third of what the rest of the world pays, according to Congressional testimony last April 18 by the Brookings Institute. Even our oil, which trades globally, may carry a small discount. Cheap natural gas will provide us with lower-cost electricity.

This new technology of horizontal drilling is destroying old paradigms as it creates new ones. New energy infrastructure is replacing old webs of transportation, chemical conversion and storage. Drilling creates new jobs and enriches the citizens in the states that encourage this new business.

Because cheap energy provides the U.S. with an economic edge, foreign investors bring plant, equipment and capital back to America. Foreigners are investing directly in our businesses. While FDI fluctuates annually, the Commerce Department reports that it reached $198 billion last year making the U.S. the largest recipient of FDI in the world.

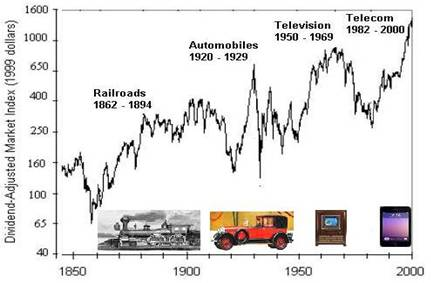

Drilling for oil and gas, however, is not glamorous. Investors react to new technologies they can see, feel and experience. They buy stocks of products they can enjoy such as the railroads, automobiles, television, and computers gave propelled previous bull markets. This 200-year graph is on JargonFree.com; the text and images are the author’s.

Three-dimensional printing may be the catalyst for this bull market as 3-D printers come to Main Street.

People can experience – and buy – these new printers. Artists can create their own Christmas gifts and decorations on 3-D printers for sale at stores including Radio Shack. Mechanics can make parts for cars such as this one that draws crowds into MakerBot stores in New York, Boston and Greenwich.

Two of the three requirements for a continued bull market are clearly in place. Perhaps the unsettled situation surrounding government regulations will pale by comparison to the glamorous investment opportunities that can be funded by a $3.6 trillion money supply.