Posts by JulianPhillips:

-

Greece, while seeing the faults of the past since it joined the Eurozone, feels it has suffered enough punishment with a contraction of its GDP and what is now a perpetual debt crisis. It now believes the bailout has stripped the nation of its dignity.

-

On the other side, Germany and the strong northern members of the E.U. need a weak euro. The southern member states ensure that through their economic weakness they will continue to enjoy a weak and weakening euro. So they would not be happy to see Greece leave the euro or the Eurozone.

- It is riveted to oil as the only currency with which oil could be bought.

- It has the largest economy in the world, until now, as China appears to be moving into that place.

- In the Weimar Republic after the first World War the German Mark fell from 4.63: $1 to 4.63 billion: $1.Germans were going around with wheelbarrows to transport the money needed for day to day transactions. Workers, when paid would rush to the gates of the factory and threw their money to wives who raced to the shops to buy whatever they could as prices rose.

One story has it that a person left their money in a bag on a bicycles outside a shop and when they returned the bag and bicycle was gone and the money left on the pavement. Nevertheless it took the total collapse of the currency before the central bank changed the currency to the Rentenmark, a currency issued against property [that could not be printed]. By this time the middle and upper classes of Germany had been wiped out financially [in the nation’s interests].

- In Zimbabwe, After the Z$: $1 U.S. traded at 1:1 it took Z$70,000 just to catch a bus to work late in the collapse of that dollar in Harare. Now in Zimbabwe, the U.S. dollar is used, in a shattered economy with 95% unemployment. But again for the benefit of the government the Z$ was used right through until it was completely unacceptable as a currency [in the national interests] It even persisted with notes that had an expiry date.

- In a tried and tested manner over the life of currencies, gold has always held international value. A Zimbabwean could go to Mongolia and get the world price for his gold. Not so with the Z$. The author has a Z$100,000,000,000,000 note in his desk that is worth less than a sheet of toilet paper.

- The inflow of dollars sold as they are excess to requirements and

- The newly bought flows of dollars back to the U.S. as other currencies fail to provide sufficient safety for investors.

- Gold remains an important element of global monetary reserves;

- The signatories will continue to coordinate their gold transactions so as to avoid market disturbances;

- The signatories note that, currently, they do not have any plans to sell significant amounts of gold;

- This agreement, which applies as of 27 September 2014, following the expiry of the current agreement, will be reviewed after five years.

- Ø The first clause confirms the ongoing role of gold as an important reserve asset.

- Ø The most important part of the statement is the third part, where the signatories confirm “they do not have any plans to sell significant amounts of gold.” In other words they have completed their sales. We do not expect them to resurrect their sales as they have fulfilled their purpose. Their sales stopped in 2010 in effect, bar some small sales by Germany of gold to be minted into coins. We did not consider these a part of these agreements.

- Ø The statement clarifies that none of the signatories will act independently of the rest and sell gold. They will coordinate any future transactions with the other signatories should a situation arise where a signatory wishes to sell again. We believe that this will not happen because of the financially strategic and confidence building nature of their gold reserves.

- Ø This agreement in lasting for five more years reassures the gold market that none of the signatories will sell gold for five years and even then they will likely make a further agreement for five more years.

A Chinese Revolution in Gold & Silver Markets in Shanghai

May 3rd, 2016By Julian Phillips.

The Yuan Gold Fix

Is now established and running effectively. It provides two daily Benchmark prices before London opens.

To date it has blended China’s gold price to London and New York, seamlessly. To date China’ has not appeared on the global gold price scene despite it being the largest buyer of gold in the world.

With the Gold Fix in Yuan now a reality Chinese prices are well known now. [We report these in our Daily Gold Report, ‘Gold & Silver Market Morning” – To get daily market reports or to subscribe, send your email address to us at: julian.smaugt1@gmail.com and we will add you to our mailing list]

The arrival of the Yuan Gold Fix on the world scene heralds a new era in global gold markets, that is changing the gold world structurally. It includes foreign members as well, so when the exports of gold from China are eventually permitted [if indeed they will be?] they will ensuring that future prices are a global representation of supply and demand.

At the moment they are reflecting these because of the presence of the ICBC in London’s gold market and LBMA price setting membership.

There are twelve fixing members (including two foreign banks): the Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, Shanghai Pudong Development Bank, China Minsheng Bank, Industrial Bank, Ping An Bank, Bank of Shanghai, Standard Charted Bank (China) and the Australia and New Zealand Bank (China). Another six companies take part in the benchmark as reference price members: China National Gold Group Corp, Shangdong Gold Group, Shanghai Lao Feng Xiang, Chow Tai Fook, Bank of China (Hong Kong) Ltd and MKS (Switzerland) SA.

The SGE Gold Fix auctions use the exchange code SHAU, and run on the electronic SGE trading platform using a ‘centralized pricing trading’ auction model. The auction is for physically-delivered 1 kg lots of 99.99% purity gold or higher, quoted in RMB per gram, with a tick size of RMB 0.01. Delivery is in the form of 1kg standard gold ingots of fineness 999.9 or higher at SGE certified vaults.

For the SGE Gold Fix, standard gold is either gold from an SGE approved refinery, or gold from a LBMA approved refinery. Settlement / Delivery is two days after trade date i.e. T + 2.

At this juncture it is important to emphasize that the Shanghai Gold Benchmark Price is a centrally cleared auction on the largest physical gold exchange in the world, which delivers real physical gold bars at any of the SGE’s 55 certified vaults.

Shanghai Gold Exchange uses 55 certified vaults across 36 Chinese cities for gold storage. Unlike the LBMA Gold Price auction which just settles and clears its trades as unallocated gold that merely exists as a book-keeping entry in the database tables of the LPMCL’s AURUM system.

The objective of the SGE Gold Fix auction is to arrive at a ‘Benchmark Price’, which is a price at which supply and demand reach a balance, while allowing a certain imbalance (less than 400 kgs) to remain. The overall auction concept is therefore similar to the LBMA Gold Price auctions in London.

Global revolution

China can now control the gold price in line with the objectives of the PBoC. Through the ICBC being a clearing Member of the London Bullion Market Association, the SGE provides a two-way market making operation, in London, that allows China to exert this control.

Bear in mind that the ICBC will only be able to sell gold, in London, from its own stocks held in its vault [previously Deutsche Bank’s] which has a 1,500 tonne capacity. It will not be able to bring stocks from its holdings in China, as exports from China are not permitted. The bank has built up stocks with which to do this in London.

The prime objective remains that China, through the ICBC and the SGE will bring into being such a level of [one-way] arbitrage business as to ensure gold prices on a 24-hour basis, globally.

Through the developments of the last few years, the Shanghai Gold Exchange is now perhaps the most liquid of physical gold markets in the world.

Because the SGE is a physical market not a ‘paper’ gold market, so it is more likely that prices reflect true physical demand and supply in their gold prices.

Effectively, the SGE will now be able to control global gold prices.

“Yijintong”

Currently the SGE has almost 10,000 institutional and over 8.3 million individual clients. Up until November 2015, the Gold Exchange counted 246 members globally, 183 domestic members and 63 international members.

In 2015 2,596 tonnes of gold were withdrawn from the SGE vaults [in comparison 2,860 tonnes were mined globally. This makes the SGE the only significant gold market in China. It is under the total control of the People’s Bank of China. Should the day come, and we believe it will, when there is a need to confiscate gold in order to add confidence to the Yuan internationally, the PBoC can do it in a day and ensure that there is no other gold market in China, with the vast bulk of Chinese gold outside the SGE forced to hand their gold back into the SGE, where it can be held in their name, but under the control of the SGE.

“Yijintong” has comprehensive functions and advanced systems, which are compatible with various Android and iOS operating systems. Right now, it possesses market, transaction, search and information functions, so investors can conduct transactions via mobile phones after opening their accounts online.

Yijintong can also enable account opening functions. New users can establish Shanghai Gold Exchange’s “Gold Account” business on their mobile phones directly, and avoid buying their gold from gold stores and banks. Hence such a function integrates the retail market to this ‘professional’ market in the case of individual investment buyers. This could lead to a fall in retail demand as it shifts to the SGE. As such retail demand figures on their own are insufficient to measure Chinese gold demand.

It is the first professional mobile terminal of state-level gold market of its kind in the world. It cuts out all the bulk of the retail market’s structure and give much tighter spreads to the individual buyer.

Download: iOS and Android mobile phone users can scan the QR code and open it in the browser to download and install directly.

The rise and expansion of the global influence of the Shanghai Gold Exchange has been poorly reported to date. Consequently, an exchange that will rule global gold prices has developed and arrived with scant attention being given to it.

It will lessen the influence of COMEX on gold prices, which have, in the last few years, dominated the gold price despite the small volumes of physical gold being traded through it.

Certainly, gold producers and physical buyers will refer to the Yuan Gold Price setting should there be a divergence of Shanghai prices and London and COMEX. The prices on COMEX are likely to follow those of the SGE over time. Likewise, London prices! We see this as inevitable, particularly because of the huge volumes of physical gold that have been moving out of London and New York to the East. We expect this trend to continue.

Just as Goldman Sachs has had to ‘stop out’ its gold shorts because of rising gold prices [bear in mind that Goldman Sachs and clients were instrumental in forcing gold prices down in April 2013] so the influence of the big New York banks and those in the London Bullion market will diminish because the drain of liquidity from the west will continue.

Comments Off on A Chinese Revolution in Gold & Silver Markets in Shanghai

What is the COMEX Futures & Options market really all about?

April 20th, 2016By Julian D.W. Phillips.

Let’s take a deep look into COMEX in this article that describes COMEX today.

All of us follow COMEX in New York and assess the ‘net speculative long position’ there, so as to see the actual weight of opinion on the gold price. It gives us a clear market opinion, after all. But many of you out there may believe that COMEX is a very large factor in the gold price. Should it be?

It would be easy of us or any other commentator to give their opinion on the matter, but would that be enough to be absolutely right? So as to not give an opinion, we felt it important to go direct to COMEX to get the proper story. We spoke to the Director of Metals Products in the COMEX Marketing Dept. This is what COMEX says;

What you may have thought about COMEX

It may seem reasonable to you to assume that the ‘net’ position on COMEX would be covered by COMEX actually ensuring that this amount of gold or silver is held in one of their four COMEX approved depositories that are all located in New York city. After all, delivery of the gold and silver is effected via electronic warrant.

This would reassure us that COMEX dealings did affect the gold or silver price, would it not? After all, supposing someone went short and could not deliver, who would supply the metals? The implications are that COMEX is constantly adjusting their gold & silver holdings to make sure that no-one would be left without the metal they bought there. Not so!

What really happens?

Does COMEX hold gold or silver to cover the net position to ensure market players will get their metal?

– COMEX does not ensure the net long positions are covered by gold or silver. But, COMEX does perform oversight and regulatory due diligence, to ensure that no adverse events disrupt the marketplace to ensure that all market participants meet their contractual obligations. Yes, holders of COMEX approved depository electronic warrants can withdraw gold and silver from the depositories.

So where do the sellers of gold or silver come from?

– The Exchange takes all short notices tendered and matches them to the appropriate long positions per an Exchange system algorithm. COMEX DOES NOT supply the gold. The Seller supplies the gold as part of the contract rules. The deliverable gold resides in four (4) COMEX approved depositories that are all located in New York City and the delivery of the gold is effected via electronic warrant. Find our warehouse stocks on a daily basis on our website: http://www.cmegroup.com/trading/energy/nymex-daily-reports.html

So if a seller doesn’t have the gold to supply to the buyer, what happens?

– COMEX positions in spot (current) month Gold are settled by trading out (rolling) of the position or engaging in the Exchange delivery process. When someone wants to take delivery, they will establish a Long (buy) futures position and wait until a Short (seller) tenders a notice to delivery.

Where does the gold come from, that’s held in approved depositories?

– Should you hold to delivery, you will get your gold! We match buyer and seller….one cannot exist without the other. The majority of positions are settled via trading as opposed to delivery. I cannot comment on where participants buy physical gold.

So how is physical delivery made?

– The gold contract is physically settled, meaning if you stay to delivery you must deliver gold or you receive gold. If you trade out of your position or roll into other month you are paid or must pay the difference. You must know that less than 1% of the trades actually go to delivery.

What if a seller [Short] does not have the gold to deliver [naked short]?

– If a short does not have Gold to deliver he must liquidate his position by the last trading day. A short which goes to delivery must have the Gold in an approved depository. This is represented by the holding of electronic depository warrants.

What percentage of sellers are ‘naked shorts’

– Don’t know what percentage of shorts do not have physical gold and am not aware that any such statistics are kept. I imagine you could get some idea by looking at open interest and comparing that to registered stocks [gold] in the depositories. [Go to the above website and check the totals against the Commitment of Traders report on Fridays and look at “Open Interst” to get that number.]

Does the COMEX gold market directly affect the gold price?

-Our markets are used primarily for price risk management or financial reasons…..although we can be a source of physical metal we are not used for that reason. The Exchange does not set the price – the market does. The gold price is created by the buyers and sellers.

The exchange in no way determines the price….we only report it.

Conclusion on COMEX

The long and short of it is that COMEX is simply a ‘cash’ market that does not deal in gold or silver or other items at all. They simply provide a’ cash’ market where risks are laid off. Yes, physical dealers in gold and silver may well use the market to ‘hedge’ opposing real physical positions so that they don’t face a price risk and yes, traders [or gamblers] use the market to take leveraged, speculative positions that are in no way backed by the physical possession of the metals.

To see how a true “Hedger” uses COMEX see the experience below of one trader protecting himself and profiting by the sound use of COMEX

Gold Forecaster gives the Fundamental and Technical reasons behind the gold price in their weekly newsletter. Subscribe through www.GoldForecaster.com

How a true Hedger acts

Many investors are puzzled by the importance of the COMEX Options & Futures markets on the price of gold.

Take a look at the Diagram here [to enlarge it put your cursor on the corner and pull it diagonally] and you see that 86% of trading in gold Futures and Options takes place in London and New York.

Many may well believe that this translates into 86% of trading in gold [physical gold] takes place in these two centers. But this is not correct. The best way to illustrate this is to give you an example of a company that manufactures gold jewelry, as its main business.

This company needs to take delivery of a tonne of gold for the manufacture of jewelry between September and the November and then deliver it to retail jewelers. Its business is manufacturing only, but it finds itself at the mercy of a constantly moving gold price. These moves can be large enough to destroy profit margins.

The company cannot afford to suffer the risks on the gold price.

It is at this point that they need to turn to the COMEX Futures & Options to lose the risk of the gold price.

The head of the jewelry manufacturing company decides on when they enter the contract to buy the needed 1 tonne of physical gold. This may be at a time well ahead of September, the delivery date. He may believe that the price he can buy for is the lowest price he will see before September. So he goes ‘long’ of one tonne of physical gold just as he needs to be, so he can take delivery in September to get on with the business he is in. He does this by buying it on a bullion market, or from a refinery, or a bullion dealer.

But can he afford to take such a risk with such a changing price in gold? The price may drop before then and he is left with a cost that may prove too much for his business.

So he ‘hedges’ by selling a tonne of ‘paper’ gold on the Futures market. Now he hasn’t ‘zero’ positions, but one physical long and one short hedge position, but zero risk, as any losses he makes on one position will be covered by profits on the other position.

Now the price drops horribly. He then believes it has gone far too low, so he buys another tonne of paper gold on the Futures market and makes a profit [technical] from his short position. Now he is left with his original physical long physical position, a ‘hedged’ short position and a new long position. The effect of his profits on his short position has left him, in effect, with a much lower price on his physical long position.

But he has a risk position, nevertheless, as the net position is; two long and one short. But netting out these is what he started with. So now the manufacturer still wants to cover his risk, although his net price is lower than the price he originally paid.

He is willing to open another short position to remove all risks if the price rises again. The price then rises again so he does open a new short position. Now he has four positions, three of which are in the Futures market. Each time he makes a ‘profit’ on matching positions, in effect he lowers his entry price.

He is not speculating, in the modern sense of the word, as the only risk he really takes is on the original physical position.

It is not uncommon for such a hedger to have 50 plus positions against the original exposure. He doesn’t need a large change in price to continue increasing his positions. The reason it is not so speculative is that his original position needed hedging and subsequent actions are only undertaken when a profit is sure.

A speculator takes a view on the price itself with no underlying motive except price direction. He usually exposes himself to high risk that remains uncovered. Frequently, such traders take losses. We questioned one trading house, who informed us that even amongst professional speculators the success rate was only 52% at best amongst amateurs.

This example helps one to understand that COMEX is not about gold supply and demand, simply about price. It is a money market separate from the gold market or the pork belly market.

It serves a vital function, but should not lead the gold price but follow it.

Comments Off on What is the COMEX Futures & Options market really all about?

To leave the euro or not to leave the euro, that is the question

February 7th, 2015

By Julian D. W. Phillips.

As we watched the Prime Minister and the Finance Minister of Greece travel though Europe in a failed attempt to re-negotiate the terms of the “Bailout” it received, we find ourselves thinking quite differently to the mainstream commentators. Ours is not a jaundiced view but a realistic one. Pragmatism demands we do so. The prime underlying factors that will be brought into play are the interests of each side.

After all, countries don’t have friends they have interests, even with fellow members of the Eurozone. These will dictate the result and likely the tactics on each side. We do not see these as friendly negotiations at all. For Greece the stakes are higher than they are for the E.U.

Not Friends, only interests!

Cutting through the rhetoric and cordiality we have been saw this week, the interests of each side are very clear.

The 25% contraction of GDP together with 50% of its youth unemployed and its skilled workforce leaving to find employment in other countries, Greece is bankrupt with no ability to repay its debt. It has little to lose. The statistics point to growth appearing again, but this is little more than cosmetic, as the damage already done will take generations to take Greece back to where it was. It doesn’t blame the E.U. entirely, which is why the new government will target the graft that has been a feature of Greek society for decades and enforce taxation on its very rich and until now, political classes who have ‘ducked’ paying up so far.

Greece has little more to lose as a default on their debt is imminent. They can’t repay the debt even if they wanted to, which they don’t. The election has committed the new government to that position. The question stands, “Is the new Government and the pain it now has, sufficient to take Greece back to the Drachma?”

With a new government voted in to clean up this mess and to give it room to recover through either the writing off or re-scheduling and restructuring of its debt, it has the mandate to do what is necessary to achieve this. The two leaders have to be determined to achieve these results for if they aren’t they will commit political suicide and that of their party. This is what they are discussing this weekend.

We are reminded of 1919 when Germany itself felt the same when it had un-repayable reparation terms imposed on it at the end of the First World War and the impact it had on Germans then and for the next 25 years. Greece can’t follow that road, but if they feel strongly enough they can exit the euro and potentially the Eurozone!

If Greece did leave it would ensure a major loss of international trade competitiveness, as the price of a strong euro would suck out the competitiveness of German and Northern member states goods, as their prices would jump with the euro. If that were to happen the euro would likely go much higher than its $1.40 peak of last year. No, the interests of the E.U. lie in keeping Greece and other southern member states economically weak, while retaining them in the Eurozone.

If we were able to measure the financial benefits to the strong member States of the E.U. we are in no doubt that the €250 billion in loans to Greece are only a small fraction of the profits gained because the euro has been much weaker than a Deutschemark would have been. Even at current levels the E.C.B. wants to see further falls in the euro exchange rate against global currencies, to stave off imminent deflation.

Spain, Italy and France are watching the events riveted to the potential outcome, which could spell the future of the Eurozone, either way. The hoped for integration of Eurozone member states always was a pipedream and a distraction from the real intent of the union of member states. As to the financial union under common rules of behavior the patterns of behavior differed so much before the formation of the E.U. that integration of such differing people was at best a vague hope, no more. Greece joined because of what it could get out of the Eurozone as did Germany and all other members. Austerity has not worked for Greece. It simply brought the country to today, close to leaving the Eurozone as a bad, bankrupt, debtor.

If Greece is successful in renegotiating its debt, or if it leaves the Eurozone and the euro, we believe that other economically weak member states will contemplate following it back to their old currencies. Then weighing the new price of German imports against, say, cheap Chinese alternatives could lead to a further decimation of exports from Northern Eurozone member states.

The history of Europe for the last 2,000 years shows that national integration, as is present in the U.S.A., is nigh on impossible. To think that that was ever a real intention was naïve. No, Greeks are Greeks, Germans are German. Never the twain shall meet. So financial realities now come to bear.

No protection from Creditors for nations!

In the case of individuals, institutions and municipalities in the developed world, when an angry creditor chases a bankrupt debtor, credit protection measures slow down the creditor. The days when a debtor would go to prison are long passed. But in the Eurozone, at sovereign level, no such protections exist.

The realities facing creditor and debtor, in the case of Greece and the E.U. are that they must slug it out pushing their own interests first. When the bruising hurts and threatened damage real, then a settlement will be reached, not before then. The Eurozone can carry the loss of the Greek debt if need be and could even enjoy a much weaker euro thereafter, but only if they accede to Greece’s terms to a large extent. Greece has now drawn a line in the sand that defines its stance and cannot afford to budge.

Writing off debt becomes the most pragmatic of options, but it seems that the Greek ministers have already ruled that out weakening their position right at the start of the negotiations by saying they did not want to write off that debt, just renegotiate it. As they sit at home this weekend they may well be contemplating a much more dramatic stance as they face the wall of resistance they saw in the E.C.B. and in Germany.

No E.C.B. loans against Greek debt from January 11

The ECB and Germany have already started the chest beating with fear and volatility hitting Greece’s financial sector, putting the government on the back foot.

The E.C.B. has stated it will not continue to give funding against Greek bonds from January 11th onwards. This threw pressure onto the Greek banking system who have put on a brave face so far. But with Greece’s back now against the wall it appears that this first hostile act is giving a mandate to the two Greek Ministers to take very strong action at a potentially greater cost to the country, but an even greater cost to the Eurozone!

With E.U. Q.E. beginning in March, it appears that Greece will lose out there too. If the E.C.B. follows through by not accepting Greek Bonds in this program too [it seems more than likely that this is the next pressure the E.C.B. will impose] it could lead to the Greek population accepting a departure from the Eurozone and the euro.

Will Greece suffer more if it writes off its debt to the E.U.? After all, the big attraction to Greece of being a member of the E.U. was the major loans and finance it was to receive. It has had these and it seems they are now being cut off, so what more is there in it for Greece? Perhaps a return to a weak Drachma will lead to a boost to the Greek economy and allow its politicians to blame the E.U. for its new woes. That way the new government would be heroes, no matter what the damage a failure to renegotiate its debt brings to Greece. To fail to achieve an acceptable renegotiated debt package would discredit the new government and the entire country’s credibility, irrevocably. It would be political suicide for the new government.

The way forward for them is clear. They have to be fully prepared to leave the Eurozone, unless the benefits of staying in it bring huge new benefits to Greece and its people.

But that message has not got across to the E.U. or Germany, yet. Our only question of the Prime and Finance Minister of Greece is, “Do they have the personal resolve to walk out of the Eurozone or not?”

Global consequences

A strong euro will hasten deflation in the Eurozone as well Draghi knows. The whole thrust of his quantitative easing policy is reliant on a weak euro. If a strong euro is seen, the entire globe will be affected. China sees the E.U. as its largest client, so a strong euro will see more Chinese goods flowing in or will deflation affect these no matter what their price is?

Deflation in the Eurozone will dampen that and affect the recovery in the U.S. The Fed is worried, as was seen in its statement of last week. The last time the FOMC statement made a direct reference to international turbulence was January 2013, when officials warned that “although strains in global financial markets have eased somewhat, the committee continues to see downside risks to the economic outlook.” Translated it means that Eurozone troubles are a danger to the U.S.’ recovery and could delay the raising of U.S. interest rates.

Comments Off on To leave the euro or not to leave the euro, that is the question

The end of Currency ‘Safe-havens’

January 31st, 2015

By Julian Phillips.

Swiss – Negative rates

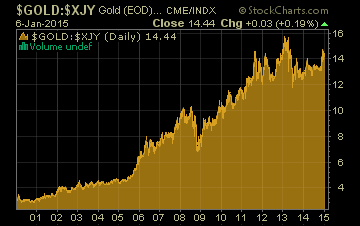

In the past [even the recent past] investors have often ‘parked’ their funds in a ‘safe-haven’ currency, when fears about the dollar or other currencies rose. The leading candidates have always been the Swiss Franc and the Yen, with gold, in the last three years usually being excluded, because of its declining trend against the dollar and the limited amount of stock relative to the availability of these currencies. While gold’s trend seems to have changed to the upside now, the developed world is still ‘out of gold’.

But gold has never forfeited its role as a ‘safe-haven’ for long. It is distinguished by the fact that there is no lasting link between gold and national governments and their national currencies. What gold has always had is the respect and the belief that it is money ‘in extremis’. For governments, through institutions to individuals, gold is always money, even between enemies.

In the last 40 years and more, the world led by the U.S., has sought to sideline gold as money, but inevitably it has proved its worth, most notably when currency crises appear. The success the dollar has had in these four decades has been largely due to two factors:

But as 2014 closed and a volatile, dramatic 2015 and 2016 entered our lives, this is changing. With oil at less than half its peak value today, only half the dollars that were used in the past for oil are being used now. Add to this that payments for oil in currencies other than the dollar, particularly by China, are being made. This is massively reducing the need for the dollar, globally. All theses excess dollars will become redundant, but the impact of this has yet to be seen or appreciated.

Euro Crisis masking the dangers

With the euro crises throwing a smokescreen over the dollar picture, as euros are exchanged for the U.S. dollar or through the ‘carry trade’ borrowed and sent into high yielding emerging market currencies, the dollar looks as though it is a strong currency.

Markets, market players and commentators tend to be myopic, focussed on short-term profits and only distracted when larger issues actually arrive. This is what’s happening now.

We feel that what is happening now on foreign exchanges is an early signal of much bigger issues that will appear in the next couple of years.

Now we will look at the traditional ‘safe-haven’ currencies of the Swiss Franc and the Yen to see just why currencies could only act as ‘safe-haven’ for a short time, while the monetary system remained free of fundamental crises, such as the ones we see now and on the horizon:

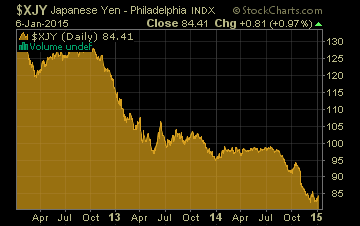

The Yen – The Yen hit its peak when it stood at 76 to the U.S. dollar before the leading source of energy [nuclear] was discarded and replaced by imported fuel.

As Japan’s population ages and spending habits become conservative, the real function of a currency has become apparent. It is used to allow the local economy to function smoothly as the only local means of exchange. Internationally, it is used as a basis for international trade and investment. As such, it functions well when the economy and Balance of Payments is healthy.

But when the Balance of Payments and the economy fail to function well, it hurts the international value of the currency as we have seen as Abenomics kicked in to lead Japan and the Yen into the future.

More importantly it now defines the trade competitiveness of the nation. Hence, the exchange rate itself, inevitably, is managed to the nation’s benefit and not that of its citizens or its own integrity. Its integrity as a measure of value has been abandoned alongside its role as a ‘safe haven’.

While the G-20 agreed that nations would not purposely weaken their exchange rates, the stark realities of today have overwhelmed these commitments and will continue to do so ‘where deemed necessary’. Translated, that means it is now OK to weaken ones currency in the interests of the nation’s export competitiveness. As most currencies follow this line and enter into the ‘race to the bottom’, any advantage to a nation becomes short-term as the one against whom the advantage was gained then does the same.

Today’s exchange rate of the Yen is 118 to the dollar a 55% fall from its recent peak. This fall is far bigger than the fall in the Ruble, albeit the Yen fell over a longer period of time. The fact that it has taken longer is OK as it can be absorbed in trade over that time. This makes the policy more palatable? The consequences of such myopia will focus on confidence. Confidence is the only ingredient that makes a currency viable and a quality that if lost takes a currency with it.

Hence the Yen is no longer a currency ‘safe-haven’.

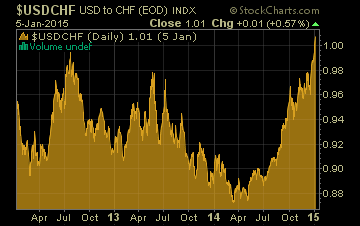

The Swiss Franc

The Swiss franc has been a hallowed currency ‘safe-haven’ for generations, consistent with the earned image of Switzerland as a ‘safe-haven’ for foreigners assets and a nation that will fight to protect these investors. The events of the last three years have cost the Swiss dearly wiping out the confidence it had gained over the previous century. As of now, at least 10% of the Swiss economy depends upon the banking/asset management industry built up over this time.

But the rest of the economy doesn’t rely on this image. As a world-respected manufacturer, Switzerland needs an exchange rate that supports its international trade competitiveness, most importantly against the euro, its main trading partner.

One would have thought that the two aspects of the Swiss economy could co-exist together easily. But when pressure on the global monetary system mounts, they can’t.

The pressure on the Swiss Franc has been heavy in the last three years when the Swiss National Bank [SNB] took severe action to hold the ‘Swissy’ to euro at a ceiling of 1.20 to guard Switzerland’s exchange rate against the euro without even contemplating the possibility that the world’s second most important currency could weaken so dramatically and so quickly from its peak against the dollar.

The pressures proved too much last week and to the great surprise of the whole world the ‘Swissy’ was unpegged! As we look around at the damage the Swiss National Bank caused by ‘unpegging’ from the euro and now linking it to a ‘trade weighted basket of currencies’, including the U.S. dollar, we see once more, national interests elevated far above those of the people using the ‘Swissy’ both inside and out of Switzerland.

Perhaps you are thinking that the ‘Swissy’ can once more serve as a ‘safe-haven’ currency. A look at the intentions of the SNB in now linking the Swissy to the ‘basket of currencies’, is to keep the Swiss Franc down against them. This means that the SNB will continue to intervene in the foreign exchanges and hold it down against these other currencies.

So it will not return to ‘safe haven’ status, as we are now seeing in the market place as it slowly slips down against gold and other currencies. In addition, the Swiss National Bank has imposed an interest rate of -0.75% on sight deposit account balances at the SNB. In an effort to relieve the upward pressure on the Swiss franc, from 22 January the SNB will charge an interest rate of 0.75% on account balances above a certain threshold held with it by banks and other financial institutions. But will this work?

In what can only be described as a break in the integrity of the Swiss National Bank, a week before unpegging the Swiss Franc, the SNB reaffirmed its commitment to the minimum exchange rate of CHF-EUR1.20, and “will continue to enforce it with the utmost determination”, they said. Further they said, “It remains the key instrument to avoid an undesirable tightening of monetary conditions resulting from a Swiss franc appreciation. Over the past few days, a number of factors have prompted increased demand for perceived ‘safe-haven’ investments. The SNB is prepared to purchase foreign currency in unlimited quantities and to take further measures, if required.”

And now?

The end of Currency ‘Safe-havens’

The very concept of a currency acting as a ‘safe-haven’ has now been destroyed by the actions of the currencies held up a one before. This reputation will not change because no country can afford to let it do so without mortally wounding its exports. It is hoped that the monetary system will survive a long time despite the undermining of the value of currencies. The loss of confidence in the currencies can go to the point of collapsing it because it is a currency managed by people who have differing agendas to the one that demands a solid value for their money. As examples of this in the past we look at how a currency is still used in a local economy while it is collapsing. Please note that governments impose it use on an unwilling public until it has collapsed.

We repeat, when a currency collapses internally, governments force its citizens to use it in day-to-day transactions until it becomes practically impossible to use it.

Such is the history of fiat currencies and will be in the future when the games governments play reach their climax.

The U.S. $ is now in the position of being the retreat from other currencies, because the world’s currencies are the branches off the tree-trunk of the dollar. But the dollar itself is under siege too. The Treasury department has made it clear that it does not want to see a strong dollar! It too must guard its international trade competitiveness by retraining a strong dollar. At the moment it is silent on this, but for how long?

Thus we have two opposing flows in the U.S. dollar:

The pressures on the dollar will take time to come to fruition and will be signaled by the failure of other currencies [such as the euro] and by the stumbling of the monetary system itself first.

Can the dollar collapse?

At the moment the dollar is the strongest of the world’s currencies and is reflecting that in its exchange rates. But this is relative strength as the dollar will, if push comes to shove be the last currency standing, even if it is itself inherently weak. It will be used as there is no alternative to it in the Western world. [That’s why China is trying to free itself from dependence on the dollar and be able to stand alone.]

If the dollar collapses it will be the last currency to collapse, after the breakdown of the monetary system itself. Even if the Yuan can stand alone, the developed world will not be permitted to exchange all other currencies for the Yuan. So no matter what the state of the dollar is, it will be used in the developed world.

Then, exchange rates will not be the measure of the dollar. When that happens, once more, the dollar, relative to other currencies will still look strong. The lack of confidence in currencies [and the dollar] will be reflected in volatility, instability and uncertainty, with many ‘hallowed’ currency standards being abandoned along the way. In turn, the Treasury and equity markets alongside institutions in the financial markets will stumble and fall. But everyone will be trying to turn to items that will be effective measures of value and means of exchange.

Among these internationally, precious metals will be at the head of the list. While individuals and institutions will turn to these markets, so will governments. As happened in 1933, governments will take such items to add credibility to their currencies and be able to say that the banking system will be ‘lending against good assets’! At that time the price of gold will not be measured by the dollar, but gold will measure the dollar.

Comments Off on The end of Currency ‘Safe-havens’

$ Long/Short position

December 12th, 2014By Julian Phillips.

In the context of the gold price, many relate the net long/short position in the US.$ as an influence on the gold price. To a small extent this may be true, but not, in our opinion, to an extent that actually affects the gold price.

Normal use

A short/long position on COMEX for instance can be used in a multitude of major and minor transactions to hedge the original $ positions so as to remove the risk of an exchange rate change a policy that has nothing to do with the future exchange rate of the dollar against any currency or against the move of gold against the dollar. A much smaller but considerably more active market is that involving speculators and traders who do view the potential for a change in the exchange rate of the dollar against any currency. It is this market that influences day-to-day prices, but not in a way that commentators often think. COMEX is a financial market where as much as 95% of all contracts are closed out before the contract matures.

Turning to the real net long/short positions in the dollar, this number includes all those where delivery will not take place as well as those that do. This muddies the water somewhat and reduce this figure to one defining expectations, not necessarily realities.

Change in expectations?

The section of this market defined as the Commercial positions reflect those positions that are conducted by the more savvy professional investors. As the dollar turned higher in recent weeks, these investors closed more and more short positions that would have cost them dearly as the dollar rose against all currencies. The expectations were that the dollar was set to rise and continue to rise, justifying long positions, not short, in the dollar.

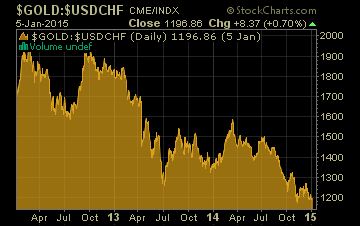

As you can see in the chart here the dollarÂs future according to the Technical picture is for it to rise by another 20% against all currencies. But it must be said that this figure is a Âtarget and often not a future reality. Even the Fed has made it clear it does not want to see a stronger dollar, as this will damage its exports and increase imports, hurting the recovery in the U.S. We believe they are already taking action to hold the dollar back.

As deflationary expectations have risen worldwide, for the last six months, alongside a rising equity market, we have seen a switch from overseas investments to dollar assets by the Âcarry trade [borrowing in dollars to lend in other countries] as they closed their positions. The rising dollar index has shown this. Gold has been made to fall back to its lows as a result until now.

ItÂs an expression of fear, not of hope when this happens, because of the rising expectation of deflation prompting a turning to Âsafe positions in the most liquid and strong currencies. Treasuries and cash are believed to be the safest of places when market falls are expected.

It may be there will be a major sell-off in Treasuries when interest rates start to rise and bond prices respond by falling. Then cash in dollars becomes the only currency haven in most investorÂs minds.

For gold too?

It is a matter of history that U.S. investors/traders/speculators take long positions in the U.S. dollar and may well either stay out of gold and the euro, or short them both. This ignores goldÂs fundamentals which show Asia and the Middle East absorbing around 80%+ of the worldÂs gold supplies annually and have considerably reduced western market liquidity in gold, a factor that may well leave Asia in control of future pricing. It is a surprise that this physical dominance of the gold market by Asia has not already translated into AsiaÂs control of the gold price. [That time is coming fast as gold liquidity has reduced to critical levels in the developed world  It may be here already]

But until that happens developed world markets will exert this Âstrong dollar  weak goldÂpositioning. As the dollar turned up, there was a global rush into U.S. treasuries and into the U.S. dollar.

Until August, the largest of the largest traders of gold and silver futures continued to report very low net short positions, right near the lowest net short positions they have had in years. The expectations are therefore that the dollar has peaked and will either consolidate around these levels [with the help of the Fed and Germany] or will fall. But from August until now short positions in gold doubled until this last week when they were hastily reduced as the gold price leapt from $1,141 to $1,218 and after a consolidation from $1,200 and the current rise to $1,230.

Following this traditional relationship, it is likely that developed world investors will go long of gold as the dollar retreats. Why has this change happened now?

The dramatic fall in the oil price has also led to a vast quantity of U.S. dollars not being used now and will return back to the U.S. This will have a heavy affect. If the fear persists and deflation becomes the new global reality, then the dollar as a national currency, faced by an expanding Yuan, loses a great deal of its appeal and gold, the non-national currency, takes on a far greater sheen. As it is still close to its low, since 2009, it becomes an even more attractive haven.

It may be that we are seeing this turn right now.

Comments Off on $ Long/Short position

The Fourth Central Bank Gold Agreement

October 10th, 2014

By Julian Phillips.

On 19th May 2014, the European Central Bank and 20 other European central banks announced the signing of the fourth Central Bank Gold Agreement. This agreement, which applies as of 27 September 2014, will last for five years and the signatories have stated that they currently do not have any plans to sell significant amounts of gold.

Collectively, at the end of 2013, central banks held around 30,500 tonnes of gold, which is approximately one-fifth of all the gold ever mined. Moreover, these holdings are highly concentrated in the advanced economies of Western Europe and North America, a statement that their gold reserves remained an important reserve asset, a statement made in each of the four agreements since then.

After 29 years of implied threats that gold was moving away from being an important reserve asset and the potential sales of central bank gold the gold price had fallen to $275 down from $850 in 1985. But the sales that were seen were so small that with hindsight they were seen as only token gestures. Today the developed world’s central banks continue to hold around 80% or more of the gold they held in 1970.

It only became clear subsequently that the real purpose behind these sales [from 1975] were to reinforce the establishment of the U.S. dollar as ‘real money’ and the removal of gold as such. The U.S. government would brook no competition from gold, but continued to hold gold [as money ‘in extremis’] in ‘back-up’.

Then in 1999 the euro was to be launched. It too needed to ensure that Europeans, who had a long tradition of trusting gold over currencies, would not reject the euro in favor of gold and turn to gold and its potentially rising price. So it was decided that while gold was to be retained as an important reserve asset, its price had to be restrained for some time, while Europeans were made to accept the euro as a reliable, functioning money in their daily lives.

To that end, major European central banks signed the Central Bank Gold Agreement (CBGA) in 1999, limiting the amount of gold that signatories can collectively sell in any one year. There have since been two further agreements, in 2004 and 2009. By the time you receive this, the fourth Central Bank Gold Agreement will be in operation. It begins on the 27thSeptember. Here is the statement on the Agreement from the signatories:

ECB and other central banks announce the fourth Central Bank Gold Agreement

The European Central Bank, the Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, Eesti Pank, the Central Bank of Ireland, the Bank of Greece, the Banco de España, the Banque de France, the Banca d’Italia, the Central Bank of Cyprus, Latvijas Banka, the Banque centrale du Luxembourg, the Central Bank of Malta, De Nederlandsche Bank, the Oesterreichische Nationalbank, the Banco de Portugal, Banka Slovenije, Národná banka Slovenska, Suomen Pankki – Finlands Bank, Sveriges Riksbank and the Swiss National Bank today announce the fourth Central Bank Gold Agreement (CBGA).

In the interest of clarifying their intentions with respect to their gold holdings, the signatories of the fourth CBGA issue the following statement:

Commentary

To us this statement and agreement removes the specter of central bank gold sales in the future. As we have seen since these sales were halted in 2010, emerging market central banks have been buyers of gold steadily and carefully, without chasing prices. We have the impression that the bullion banks go to prospective central bank buyers and ‘make the offer’ of gold available on the market, which the central bank then buys. They do not announce their intentions and act so as not to affect the price barring taking stock from the market. This not only reassures gold-producing countries and companies, who can be reassured that there will be no policy of undermining the price of gold with uncoordinated sales of gold, but tells the rest of the world including emerging central bank buyers that there will be no supplies from them put on sale. Such buyers will have to find what gold they can on the open market or from their own production.

Comments Off on The Fourth Central Bank Gold Agreement

Three countries to emerge from Iraq as we know it now!

August 10th, 2014

By Julian Phillips.

In the last few weeks the story of Iraq has faded from the headlines to be replaced by the story on the Ukraine, Gaza and on the business front the tumble of the Dow on the New York Stock Exchange.

But right now in the world we are watching many structural changes taking place quietly but completely. One is the shift of wealth and power to the east, the rise of the Yuan and its use in a growing number of global transactions in the place of the U.S. dollar. At the moment Russia is turning its economic head towards China and the developed world doing its best to do so too. And still the east is gaining ground and its share of global cash flow has doubled from 20% to 40% since the beginning of the century. This is set to continue strongly.

These developments are sending warning signals to us not just that the developed worlds share is waning, but the grip on the worlds currencies by the U.S. dollar has to weaken over time. Not only is the threat to the dollars hegemony growing from the Yuan, but key to that role, its dominance over the oil price, is in danger.

Of comfort to the U.S. is its rapid rise to oil self-sufficiency, shrinking the threat from the future oil market to the dollar oil price. But this is extremely critical to the U.S. because it has to retain dollar hegemony primarily because it runs a constant Trade deficit. If it is required to pay for goods in currencies other than the dollar it is in trouble. The dollars role as the sole global reserve currency will happen, but of more importance will be the loss of its power over global financial markets. As it is the U.S. dollar has lost its power over China. With $4 trillion in its reserves and its growing ability to trade in the Yuan and not the dollar it seems secure from any U.S. action to curb its financial power in the world. The only recourse the U.S. has over China will be over that $4 trillion and we wonder if its actions to prevent BNP Parisbas using the U.S. dollar could possibly be considered by the U.S. under some circumstances?

Apart from that, the U.S. considers the Middle East oil supplies as part of its vital interests in terms of its global power and the power of the dollar. Ask yourself, if most nations were able to pay O.P.E.C. in any currency, what importance would the U.S. dollar hold. Its critical use would be limited to trade with the U.S. The liquidity of the U.S. dollar market does prevent the easy use of softer currencies but the liquidity of the euro, sterling, the Swiss Franc and then Yen, together with the arrival of the Yuan on the global scene would provide sufficient liquidity in place of the dollar. Then where would all those excess dollars go and what would be their value?

So it is in this context that the importance of the situation in Iraq now becomes of disproportionate importance to the monetary world.

In trying to extrapolate what will happen there we have to look at the Middle East with eyes that are neither geographical nor political. We have to look at the religious battles going on there and see where they are going to see what will happen to the oil price and in what currency it will be traded.

As a glimpse of the importance of these issues, the seizure of an oil tanker sent to the U.S. for the sale of oil by the Kurds of Iraq, by the U.S. last week has caught our attention.

The changing Iraq

With the declaration of a new country straddling the borders of Syria in the west and Iraq in the east, the scene is set for the full disintegration of Iraq into three countries along sectarian lines. We now look at what countries lie ahead in the region;

Each of the borders to these countries will be embroiled in war against each other. The sectarian issues have overwhelmed any political issues, which are being swamped in the process.

Even the U.S. has lost its influence with the exception of supplying arms to the government it instituted before it left. This governments history of corruption and prejudice against Sunnis is where the war will become centered.

Kurdistan

We see the most northerly country being Kurdistan [in cream on the, map], unlikely to want to give up its autonomy rapidly becoming sovereignty and so consolidating its hold on the oilfields of Kirkuk.

The Islamic State

The second country is the new caliphate under the Sunnis [in light brown on the map], again, because of bitter experience of its treatment under an integrated government in Bagdad, unlikely to want to merge into a future integrated government even if moderate

Sunnis win out over ISIS [most unlikely].

The Shia State of Iraq

The third country will be in the south [in the darker green] under the Shiites, in command of the bulk of the nations oil [3m barrels per day] and export terminal at Basra.

While we see this as the outcome, the cost to the country is likely to be extraordinarily high as the polarization of the two sides of Islam, which will, no doubt, come, will leave the rest of Iraq facing religious cleansing because of the many remaining mixed areas of the country, including Baghdad [in light green on the map], where blood baths have and will surely ensue as different groups tried to establish their dominance in these undefined areas, as you can see on the map here and chase those not of their religion out of those areas.

Iranian involvement

With Iran, their historic enemy, now lining up drones and other military supplies to help the government of Prime Minister Nuri Kamal al-Maliki retake the north and protect the south, many Sunnis are becoming become further alienated from the state. But we do not see the current support of the American instituted government in Bagdad, by Iran, as being committed to that government, but certainly committed to the Shiites in the country. This is not about secular government, or simple geography, it is about religion and oil.

The rapid invasion of Iraq by the Islamic State in Iraq and Syria, which supplied the shock troops of the assault on Mosul, has made vigorous efforts to inculcate a new identity for those living within its growing transnational sphere, setting up Shariah courts and publicizing videos in which its fighters burn their passports. Recently, the group issued an eight-page report denouncing the Middle Eastern border system as a colonialist imposition, and included photographs of its fighters destroying what it called crusader partitions between Iraq and Syria.

Across the border in Syria, a Kurdish region in the countrys north is also effectively independent of Damascus, with its own military and provisional government. And Turkey, which in the past strongly opposed an independent Kurdish state on its border, now sees the Kurds as a stable buffer between itself and the extremists of ISIS.

In Iraq, it has long been assumed that the Shiite heartland of southern Iraq, where the major oil fields are, would give the Shiites a tremendous advantage, leaving the Sunnis with only the vast landlocked deserts to the north and west. But northern Iraq also controls both of the countrys major rivers, the Tigris and Euphrates, which flow southward toward Basra.

The prospect of a more formal partition in Iraq or Syria would also lead to mass migrations and further turmoil, judging by some recent examples of state partition, like the division of Sudan in 2011, or that of India and Pakistan in 1947. Those breakups were the result of long struggles and led to terrible violence.

Prospects for gold and oil

While exports from the terminal at Basra are trying hard to make up for lost exports in the north and the oil price has only hit $115, should the conflict see ISIS try to attack the south-west of Iraq and Bagdad, we do see speculators pushing oil prices up to $140.

We also see Iran taking far more aggressive actions by sending in troops overtly or covertly [which they are doing now] to secure the Shia country. If the current government collapses [looking very likely right now], we see Irans moves to protect the Shiites as certainly including controlling Basra.

They would, we feel try to pacify the U.S. and the oil world by maintaining the current production levels. A failure to work with Iran, no matter the political compromise involved, would see oil prices move up over $140 to the detriment of every economy on this globe!

But would Iran be paid in dollars? Or as we see Iran, currently under the control of the U.S. vis-a-vis its oil exports [until the nuclear issue is resolved], having these controls lifted.

Already it supplies China and will have the option of doing so with Iraqi oil too. With the punishment of BNP Parisbas in mind, we would expect Iran to be happy to receive Yuan [Renimbi] in payment of its oil. This would weaken dollar hegemony and blaze a trail for other nations to move away from the dollar [as it is now more overtly political]. This will directly impact the global monetary system and dollar hegemony.

As to gold, three factors emerge:

1)The forecasts of the WGC OMFIF report come onto center stage.

2)The actions of the Iraqi government in buying 90 tonnes of gold can now be seen in context as its currency begins to lose all credibility, as ISIS robs the banks it invades taking the management of that currency to untenable levels.

3)With the Middle East responsible for 20% of the worlds physical gold demand last year, we expect their demand to jump not simply at retail levels but at central bank levels. Whenever war comes into the picture, one of the first casualties is the local currency. The Ukraine is a recent example of this. Even though the country is not at full scale war levels, their currency has fallen 45% this year already.

Comments Off on Three countries to emerge from Iraq as we know it now!

China controls the Gold Price

April 30th, 2014

By Julian Phillips.

In addition to the latest excellent study of the Chinese gold market by the World Gold Council, we have received other reports on the Chinese gold market that differ with the conclusions drawn by the World Gold Council. But we shouldn’t be surprised by this, not only because of the opaque nature of the Chinese gold market and the dearth of accurate statistics that are accessible. Which ones are right is critical for the conclusions each draw paint very different pictures of the future of the gold price.

What has come through the pages of this and other reports on the gold market there is that China is not only the main force in the global gold market, but they control the gold market. With the acquisition of so much gold in the last year and an ongoing persistent demand in the future, they have effective control of the gold price and the market. They play their control very cleverly so that it is not apparent.

You may be asking, so why isn’t the gold price at $2,000 or much, much, higher? It’s because they have found a way to buy gold without pushing up the gold price.

If we are to believe the numbers being put out by the Shanghai Gold Exchange, plus local gold production, government and local buyers absorbed just 400 tonnes short of the entire world’s newly mined gold. This leaves just scrap [a diminishing number at these prices] and all disinvestment [including the 880 tonnes from U.S. gold ETFs plus the 400 tonnes of physical gold sold by Goldman Sachs and J.P. Morgan Chase and both their clients, in 2013] left for the rest of the world.

2014 will be a different matter because the 1,280 tonnes sold out of the U.S. last year has gone and we do not expect it to return. This has reduced supply back to slightly more than 4,000 tonnes. Just this alone creates a demand bottleneck, which has to shrink if the gold price is to remain at current levels. If, of course, India eases gold import restrictions, then demand will expand by another 500 tonnes, thereafter. That supply is not available at current prices!

If the World Gold Council’s number of 1,132 tonnes of gold imported into China is correct, the gold price is likely to trade higher because of the loss of U.S. supply. If we are to believe the numbers delivered by the Shanghai Gold Exchange then the gold price cannot remain at current levels and 2014 will prove a watershed year for gold!

As well as being inscrutable, the Chinese are canny buyers. There have been no reports of Chinese central bank buying, because the People’s Bank of China does not buy gold directly. It uses agents who, when the P.B.O.C. decides it is in the national interests to revise their gold reserves, deliver the gold, bought on their behalf, through S.A.F.E., the agency buying for them.

We are certain China, through their selected bullion banks, are buyers of gold both for the retail market and for the ‘official’ in both London and New York ‘on the dips’. This ensures they are only seen by their bankers, when their dealers have stock to sell. We do not believe that China chases prices. As a result, the bullion banks, licensed to import gold into China, are not visible as Chinese buyers, but just as another professional acting for unknown clients, leaving China’s presence in the market almost unnoticed.

To ensure prices stay low, the gold they buy comes mainly from ‘off-market’ sources. And this is the key to getting volume at the right price. As you noted in our last article, the gold price is not an accurate reflection of demand and supply. If China can source gold directly from refiners, gold miners and other markets and use a ‘reference’ price to price that gold, then there is no danger that the sheer volume of gold they buy will disturb the markets where gold is priced.

Many gold miners and refiners use the p.m. Gold Fix as a price used for contracts. It is no strange matter for this to happen. It by-passes markets and lowers costs. More importantly there are no on-market rumors inciting professionals to ramp up prices to make it difficult for the Chinese to buy.

China has been a buyer of gold mines across the world. The gold mined there will follow the direct route to China. What this pattern of buying does is to draw in a huge volume of gold, taking stock out of the market and away from traditional buyers.

A vital point that we need to make regarding China is;

China wants ounces of gold and will act to encourage that objective. Price must be used as a tool to encourage more supply.

If this is best achieved by lower prices, then China will act to ensure lower prices. If higher prices are what it takes they will act accordingly. The only word of caution here is that low prices enable the available discretionary savings of consumers in the retail market to buy a greater volume of gold than higher prices would.

While the leading U.S. banks believe they control the gold price and that it will move in the opposite direction to the state of the U.S. economy, the reality is that if China decides to lift prices because it can access more gold, it can easily do so. If it prefers lower gold prices it can engineer the situation to leave them low. They have full control in this regard.

Neither U.S. banks, nor High Frequency Trading has the power to lower their control. Indeed it appears that the Chinese are taking full advantage of those in the U.S. who want to see lower gold prices and making room for them. What these market players are doing is ensuring that gold in the developed world is moving from west to east ahead of a time coming, in the near future, that will require as much gold as possible to be accessible to nations in a changing, turbulent, financial world.

In our next article we look at whether the major central banks are leasing too much gold and whether they can get it back of face default.

Comments Off on China controls the Gold Price

Does the Gold Price reflect true gold Demand and Supply?

April 11th, 2014

By Julian Phillips.

In short, no it doesn’t! We will look at why not, in this article.

The Gold Fix

Despite the furore surrounding the Gold Fix [unfairly, we believe] it is a singularly determined attempt amongst commodities to set a twice daily price that does reflect demand and supply of gold, at those moments. To understand this we have to see what happens at the Fixing sessions.

The five banks involved in fixing the morning and afternoon Fix of the gold price open a conference line to each other at 10.30a.m. and at 3.00p.m. in the afternoon. At the same time each bank opens their lines to contact their main clients, who could include mining companies, refiners of gold, jewellers, gold dealers and all the main professionals in the gold market. In turn these professional open their lines to their main clients which could also include central banks as well as wealthy individuals and other gold markets. These then react to a price put up by the Chairman of the Fix, representing his bank. This price is sent down the lines and each participant states the amount they are net buyers or sellers of. Each bank ‘nets out’ the demand and supply among his own clients before passing on the net order to the Fixing. At each price, orders down the line change and the price adjusted accordingly. Once the market is agreed upon a particular price all transactions are done at that price.

Bulk of Gold contracted

However, the amounts dealt do not include all the gold bought and sold in the market at that time. Many dealers, miners and jewellers refer to the Fixing price of gold and contract to deal at a price that reflects, usually, the afternoon Fix. This is deemed to be the most reflective of global demand and supply, at that particular moment, in time. But the fact that amounts of gold are dealt outside the market, with reference to the Fixing price, tells us that much of the world’s gold and supply does not go through the London market. The claim that 90% of gold’s demand and supply goes through the London market is therefore conjecture, not fact. It is impossible to say just how much gold is priced by reference to this Fix and not dealt in the market place, but it is substantial.

Outside the main markets

For instance, we believe that the bulk if not all of China’s internal gold production does not pass through the Shanghai Gold Exchange, but is sold directly to the agency that buys gold for the People’s Bank of China. This is around 430 tonnes per annum currently. These miners, it is thought are paid in the Yuan equivalent of the Gold Fixing price. Refiners selling directly to clients [who can be central banks dealing directly with them, banks taking stock, for delivery to markets elsewhere, large jewellers seeking a reliable, regular, source of gold, etc.] will follow the same practice. Most gold-backed U.S. exchange-traded funds use the London afternoon gold fix to calculate their net asset value, which in turn is used by ETF custodians to calculate their fees. The U.S. Mint and Royal Canadian Mint also price their products based on daily London p.m. gold fixes, or average weekly fixes. Many miners are active listeners to the fixing process as sellers.

Reflecting Marginal Demand and Supply of Gold

Therefore, as it the case with most commodity markets, the amount of gold actually bought and sold during the Fixing may well reflect the marginal demand and supply that falls outside the large contracts due to unforeseen changes in demand and supply. It is also where speculators who deal in physical gold buy and sell often to support their positions in the futures and Options markets on COMEX in the U.S.

COMEX, while a huge financial gold market only sees around 5% of these contracts result in a physical movement of gold. That’s after one party or the other gives notice that he wants physical delivery or supply. Such manipulation of gold prices is most frequently seen just ahead of the month end when contracts mature.

Manipulated?

Charges that insider trading goes on in the Fixing, we believe are false. What does happen is that clients accessing the Fixing process then deal in the gold market on COMEX on the basis of the process. Add to this high frequency trading and you can see where the profit opportunities are. But we believe that few of these operators would risk dealing in physical gold in the Fixing, as that may work against them, increasing their risks. More profit lies in dealing in Futures and Options, on the side, we feel. What is transparent to all involved in the Fixing [who have an interest in that price] are online in the Fixing, so see a very transparent process going on in which they can partake. Those not involved but with a need to reference the price in their dealings, usually do not deal at the Fixing, but wait for the price to be Fixed before finalizing prices.

Conclusion

Hence the changing daily prices at the Fix, while not representing the total amount of gold bought and sold are the only reasonable reflection of the current gold price. We therefore expect that price to be treated as a reliable reflection of the current demand and supply of gold.

Comments Off on Does the Gold Price reflect true gold Demand and Supply?

Will Renewed Indian Demand Drive Gold Prices much Higher? Revised –dramatic difference!

March 18th, 2014

By Julian Phillips.

Current Situation

Since last August, the Indian government placed a stranglehold on gold imports into the country by requiring that 20% of all gold imported be exported as jewellery. This forced the amount of gold imported to drop to 30% of former levels until October of last year. Then the amount imported rose to 38 tonnes a month and has been at that level since then. The amount of gold that was expected to be imported for the year was north of 1,200 tonnes. It only achieved an imported total of 825 tonnes, around 400 tonnes less than expected. So on the surface an easing of restrictions would have little impact on the gold price in London.

Lifting of restrictions

If, as we expect, the Indian government eases these restrictions in the end March budget, seven days ahead of the elections there, will it cause a jump in demand from the London market [where India sources its gold from] sufficient to send the gold price soaring? It appears so, until we peer under the obvious at the basics.

The reason the government gave was that it had to curb its Current Account Deficit, which has been part of the solution. It has since ‘officially’ pared that deficit back substantially. To ease restriction at the end of March would gain votes for the government, so it has every incentive to do so.

Smuggling incentivized

However, a simple easing up on restrictions will not be sufficient to increase demand. The reason is the very high duties the government started to raise from the start of 2013. At a total of 15% the duties on gold provide every incentive to smugglers to bring gold in illegally. It is guesstimated that 250 tonnes of gold are entering the country illegally and likely more. We guess this figure by the perceived shortages in the internal gold market there. At 250 tonnes of smuggling, there would be a shortfall on total imported volumes of gold on last year’s expected 1,200 tonnes of 150 tonnes if we work on the basis of these numbers. However, if we take the 38 tonnes a month and annualize that we get to 456 tonnes, which together with the 250 tonnes smuggled only takes total imported gold to 706 tonnes a 500 tonne shortfall on demand.

If the government dropped duties to 5% or less, the incentives to bring in gold illegally would fall dramatically. Would this stop smuggling? No, because the shortage of gold would persist. What it would do is to add a ‘shortage’ premium to the gold price over and above legally imported gold’s prices that would ensure continued smuggling.

Current Account Deficit not dropping so much

One advantage to the government in allowing the current restrictions to persist is that the costs of smuggled gold are not added to ‘official’ figures when calculating the Current Account Deficit, giving the impression that it is dropping, when the reality is that it is not dropping anywhere near as much as reported by the government.

But the second reality is that the restrictions are keeping around 40% of demand for imported gold back. In part this is a defeat for government. Hence, there is little point in maintaining restrictions on gold imports.

Their political unpopularity must be weighed against the extra revenue the government is drawing in on the legally imported gold. With election beginning on April 7th we expect to see restrictions convincingly lifted so as to gain the most votes.

How much volume of gold would then be imported and its impact on gold prices?

What will that do to the volume of gold imports? We believe it would add a real total of around 500 tonnes and of demand to the London market. Is this enough to boost prices? Oh, yes! Now add the growing levels of total Asian demand and you see that the demand / supply levels are going to tip to a deficit in terms of available gold [We do not consider all above ground gold as available]. Rather like a see-saw tipping over almost any additional demand will overwhelm supply, let alone an additional 500 tonnes.

Supply has fallen by 1200 tonnes from 2013 [total estimated 5.500 tonnes] as U.S. sales have fallen away. So an amount of far less that 500 tonnes would have a disproportionate impact on the market, particularly when Indian and Chinese demand is growing constantly. If allowed to import all the gold wanted by Indian investors we may see 1,300 tonnes or more of demand from Indian investors in 2014.

Yes, gold prices would be pushed higher and likely much higher, by an easing of duties and restrictions on Indian gold imports!

Comments Off on Will Renewed Indian Demand Drive Gold Prices much Higher? Revised –dramatic difference!

Renewed Indian Demand Driving Gold Prices Higher?

March 7th, 2014

By Julian Phillips.

Current Situation