Posts by RichardMills:

- Moss Mine has 200,000 Oz Gold (M&I) not included in the BFS

- Moss Mine Resource remains open at depth and on Strike to the East and West for more than 3kms

- Frank Vanderlip, president of the National City Bank of New York, associated with the Rockefellers

- Henry P. Davison, senior partner of J.P. Morgan Company, regarded as Morgan’s personal emissary

- Charles D. Norton, president of the Morgan dominated First National Bank of New York

- Col. Edward House, who would later become President Woodrow Wilson’s closest adviser and founder of the Council on Foreign Relations

- Benjamin Strong, a lieutenant of J.P. Morgan

- Paul Warburg, a recent immigrant from Germany who had joined the banking house of Kuhn, Loeb and Company, New York directed the proceedings and wrote the primary features of what would be called the Aldrich Plan.

- Between 1997 and 2005 mortgage fraud increased by 1,411 percent.

- In 2001 the US Federal Reserve lowered the Federal funds rate eleven times, from 6.5 percent to 1.75 percent.

- Mortgage denial rates were 28 percent in 1997, in 2002 – 2003 they were 14 percent for conventional home purchase loans. “Fog the mirror loans” were common, if you breathed you got a loan.

- In June 2002 President George W. Bush set out to increase minority home ownership by 5.5 million. Bush’s lofty goals would be accomplished by tax credits, subsidies and Fannie Mae committing $440 billion to establish Neighbor Works America.

- In June2003 Federal Reserve Chair Alan Greenspan lowered the federal reserve’s key interest rate to one percent – the lowest rate in 45 years.

- Throughout 2003 Fannie Mae and Freddie Mac bought $81 billion in subprime securities. President Bush signed the American Dream Down payment Act – the Act provided a maximum down payment assistance grant of either $10,000 or six percent of the purchase price of the home, whichever was greater.

- U.S. homeownership rate peaked to an all time high of 69.2 percent in 2004.

- From 2004 to 2006 Fannie Mae and Freddie Mac purchased $434 billion in securities backed by subprime loans.

- In late 2004 the Securities Exchange Commission (SEC) suspended net capital rule for five firms – Goldman Sachs, Merrill Lynch, Lehman Brothers, Bear Stearns and Morgan Stanley. Free from government imposed limits on the amount of debt they could assume, they all levered up, as much as 40 to 1.

- TheUnited States housing market bubble burst in the fall of 2005. By year-end a total of 846,982 properties were in some stage of foreclosure. From the fourth quarter of 2005 to the first quarter of 2006, median prices nationwide dropped off 3.3 percent.

- The U.S. Home Construction Index was down over 40 percent as of August 2006. A total of 1,259,118 foreclosures were filed in 2006, up 42 percent from 2005. Homeowners were going underwater (they owed more than the house was worth) and many had had questionable credit to start with.

- In 2007, lenders started foreclosure proceedings on nearly 1.3 million properties, a 79 percent increase over 2006.

- Foreclosure proceedings increased to 2.3 million in 2008, an 81 percent increase over 2007 and increased by another half million in 2009 to 2.8 million. By January 2008, the mortgage delinquency rate had risen to 21 percent and by May 2008 it was 25 percent.

- By August 2008, 9.2 percent of all U.S. mortgages outstanding were either delinquent or in foreclosure. By September 2009, this had risen to 14.4 percent.

- The System Open Market Account (SOMA) purchased mortgage-backed securities guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae (agency MBS).

- The Term Auction Facility was $40 billion in loans to rescue the banks. It wasn’t near enough, the Treasury department got authorization to spend $150 billion more to subsidize and eventually take over Fannie Mae and Freddie Mac, they also bailed out AIG.

- Dollar Swap Lines exchanged dollars with foreign central banks for foreign currency to help address disruptions in dollar funding markets abroad.

- The Term Securities Lending Facility auctioned loans of U.S. Treasury securities to primary dealers against eligible collateral.

- The Primary Dealer Credit Facility provided overnight cash loans to primary dealers against eligible collateral.

- The Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facilityprovided loans to depository institutions and their affiliates to finance purchases of eligible asset-backed commercial paper from money market mutual funds.

- TheCommercial Paper Funding Facility provided loans to a special purpose vehicle to finance purchases of new issues of asset-backed commercial paper and unsecured commercial paper from eligible issuers.

- The Term Asset-Backed Securities Loan Facility supported the issuance of asset-backed securities (ABS) collateralized by loans related to autos, credit cards, education, and small businesses. In March 2009, the Fed announced that it was expanding the scope of the TALF program to allow loans against additional types of collateral.

- The Troubled Asset Recovery Program was proposed and $350 billion was approved by Congress – the money was used to buy bank and automotive stocks.

- “In Dimon’s (JPMorgan Chase CEO Jamie Dimon) case, JPMorgan received some $391 billion of the $4 trillion in emergency Fed funds at the same time his bank was used by the Fed as a clearinghouse for emergency lending programs. In March of 2008, the Fed provided JPMorgan with $29 billion in financing to acquire Bear Stearns. Dimon also got the Fed to provide JPMorgan Chase with an 18-month exemption from risk-based leverage and capital requirements. And he convinced the Fed to take risky mortgage-related assets off of Bear Stearns balance sheet before JP Morgan Chase acquired the troubled investment bank.

- Another high-profile conflict involved Stephen Friedman, the former chairman of the New York Fed’s board of directors. Late in 2008, the New York Fed approved an application from Goldman Sachs to become a bank holding company giving it access to cheap loans from the Federal Reserve. During that period, Friedman sat on the Goldman Sachs board. He also owned Goldman stock, something that was prohibited by Federal Reserve conflict of interest regulations. Although it was not publicly disclosed at the time, Friedman received a waiver from the Fed’s conflict of interest rules in late 2008. Unbeknownst to the Fed, Friedman continued to purchase shares in Goldman from November 2008 through January of 2009, according to the GAO.

- In another case, General Electric CEO Jeffrey Immelt was a New York Fed board member at the same time GE helped create a Commercial Paper Funding Facility during the financial crisis. The Fed later provided $16 billion in financing to GE under this emergency lending program.” Fed Board Member Conflicts Detailed by GAO, http://www.sanders.senate.gov/

- Jamie Dimon, the Chairman and CEO of JP Morgan Chase, has served on the Board of Directors at the Federal Reserve Bank of New York since 2007. During the financial crisis, the Fed provided JP Morgan Chase with $391 billion in total financial assistance. JP Morgan Chase was also used by the Fed as a clearinghouse for the Fed’s emergency lending programs. In March of 2008, the Fed provided JP Morgan Chase with $29 billion in financing to acquire Bear Stearns. During the financial crisis, the Fed provided JP Morgan Chase with an 18-month exemption from risk-based leverage and capital requirements. The Fed also agreed to take risky mortgage-related assets off of Bear Stearns balance sheet before JP Morgan Chase acquired this troubled investment bank.

“I just think this constant refrain, ‘bankers, bankers, bankers’ — it’s just a really unproductive and unfair way of treating people. People should just stop doing that.” Jamie Dimon

- Jeffrey Immelt, the CEO of General Electric, served on the New York Fed’s Board of Directors from 2006-2011. General Electric received $16 billion in low-interest financing from the Federal Reserve’s Commercial Paper Funding Facility during this time period.

- Stephen Friedman. In 2008, the New York Fed approved an application from Goldman Sachs to become a bank holding company giving it access to cheap Fed loans. During the same period, Friedman, who was chairman of the New York Fed at the time, sat on the Goldman Sachs board of directors and owned Goldman stock, something the Fed’s rules prohibited. He received a waiver in late 2008 that was not made public (the Fed provided conflict of interest waivers to employees and private contractors so they could keep investments in the same financial institutions and corporations that were given emergency loans). After Friedman received the waiver, he continued to purchase stock in Goldman from November 2008 through January of 2009 unbeknownst to the Fed, according to the GAO.During the financial crisis, Goldman Sachs received $814 billion in total financial assistance from the Fed.

- Sanford Weill, the former CEO of Citigroup, served on the Fed’s Board of Directors in New York in 2006. During the financial crisis, Citigroup received over $2.5 trillion in total financial assistance from the Fed.

- Richard Fuld, Jr, the former CEO of Lehman Brothers, served on the Fed’s Board of Directors in New York from 2006 to 2008. During the financial crisis, the Fed provided $183 billion in total financial assistance to Lehman before it collapsed.

- James M. Wells, the Chairman and CEO of SunTrust Banks, has served on the Board of Directors at the Federal Reserve Bank in Atlanta since 2008. During the financial crisis, SunTrust received $7.5 billion in total financial assistance from the Fed.

- Richard Carrion, the head of Popular Inc. in Puerto Rico, has served on the Board of Directors of the Federal Reserve Bank of New York since 2008. Popular received $1.2 billion in total financing from the Fed’s Term Auction Facility during the financial crisis.

- James Smith, the Chairman and CEO of Webster Bank, served on the Federal Reserve’s Board of Directors in Boston from 2008-2010. Webster Bank received $550 million in total financing from the Federal Reserve’s Term Auction Facility during the financial crisis.

- Ted Cecala, the former Chairman and CEO of Wilmington Trust, served on the Fed’s Board of Directors in Philadelphia from 2008-2010. Wilmington Trust received $3.2 billion in total financial assistance from the Federal Reserve during the financial crisis.

-

Gross revenues fell to $7.7 billion in 2015, compared to $8.2 billion in 2014.

-

Capital expenditures are declining – $1.2 billion in 2015, $1.5 billion in 2014, $1.785 billion in 2013.

-

Seven mines were put on care and maintenance by the end of 2015,

-

Exploration expenditures dropped to $272 million in 2015, from about

-

The decreasing land base available to exploration/mining

-

The lack of clarity in land access and use rules

-

The overlapping nature of government regulations

-

Excellent geology

-

Good transportation (road & rail) system

-

Competitive tax rates

-

Strategic location with respect to Asian markets. Two modern ports, Vancouver – Canada’s largest and the Port of Prince Rupert which is the closest of any of North America’s West Coast ports to Asia – up to 58 hours of sailing time shorter

-

High quality and easily accessible geological data

-

Mining friendly provincial government

-

Communities receptive to resource extraction as a livelihood

-

Attractive exploration incentives

-

BC is the third largest generator of hydro electricity in Canada – one of the lowest power costs in North America. Natural gas is plentiful, cheap and resources are growing

-

Some of the most modern education and telecommunications infrastructure in the world

-

The acreage necessary to produce a certain amount of calories from any livestock is drastically greater than the required acreage to produce the same amount of calories from plants

-

Livestock agriculture requires additional acreage to grow the grains needed for livestock feed

- Medical advances lessened the mortality rate in many countries

- Massive increases in agricultural productivity because of the “Green Revolution”

- Development of high yielding varieties of cereal grains

- Expansion of irrigation infrastructure

- Modernization of management techniques

- Mechanization

- Distribution of hybridized seeds, synthetic fertilizers, and pesticides to farmers

- Plants with the largest seeds were selected for breeding to create the most production

- By maximizing the seed or food portion of the plant, the plant is able to use photosynthesis more efficiently because the energy produced during this process went directly to the food portion of the plant

- By selectively breeding plants that were not sensitive to day length, researchers doubled a crop’s production because the plants were not limited to certain areas of the globe based solely on the amount of light available to them

- Fertilizers

- Irrigation

- Pesticides

- Unsustainable farming – intensive farming depletes the nutrients in the soil

- Overgrazing – animals eat away grasses and erode topsoil with their hooves

- Deforestation or clear-cutting of land – the tree and plant cover that binds the soil is removed

- Misuse of water resources

- Industrial activities

- The Arabian Aquifer System, which supplies Saudi Arabia, Syria, Iraq, and Yemen

- Yhe Murzuk-Djado Basin in northern Africa

- The Indus Basin of India and Pakistan

- The Central Valley Aquifer System in California

- Variations in the Earth’s orbital eccentricity – the shape of the orbit around the sun, a 100,000 year cycle

- Changes in obliquity or tilt of the earth’s axis – changes in the angle that Earth’s axis makes with the plane of Earth’s orbit, a 41,000 year cycle

- Precession – the change in the direction of the Earth’s axis of rotation, a 19,000 to 23,000 year cycle

- Changes occurring within the sun affects the intensity of sunlight that reaches the Earth’s surface. These changes in intensity can cause either warming – stronger solar intensity – or cooling when solar intensity is weaker.

- Volcanoes often affect our climate by emitting aerosols and carbon dioxide into the atmosphere. Aerosols block sunlight and contribute to short term cooling, but do not stay in the atmosphere long enough to produce long term change. Carbon dioxide (CO2) has a warming effect. For about two-thirds of the last 400 million years, geologic evidence suggests CO2 levels and temperatures were considerably higher than present. Each year 186 billion tons of carbon from CO2 enters the earth’s atmosphere – six billion tons are from human activity, approximately 90 billion tons come from biologic activity in earth’s oceansand another 90 billion tons from such sources as volcanoes and decaying land plants

- The heating or cooling of the Earth’s surface can cause changes in greenhouse gas concentrations – when global temperatures become warmer, CO2 is released from the oceans and when temperatures become cooler, CO2 enters the ocean and contributes to additional cooling. During at least the last 650,000 years, CO2 levels have tracked the glacial cycles – during warm interglacial periods, CO2 levels have been high and during cool glacial periods, CO2 levels have been low

- The heating or cooling of the Earth’s surface can cause changes in ocean currents. Ocean currents play a significant role in distributing heat around the Earth so changes in these currents can bring about significant changes in climate from region to region

- China – $9,233

- Indonesia – $4,956

- Philippines – $4,410

- India – $3,876

- Pakistan – $2,891

- Declining ore grades means a much larger relative scale of required mining and milling operations. As a rule grades are higher at current mining operations than at development stage projects – so costs are going to be higher to remove/process the same amount of ore.

- A growing proportion of mining projects are in remote areas of developing economies where there’s little to no existing infrastructure.

- Weather/Natural Disasters – Rain caused flooding or the opposite, drought causing water shortages, hurricanes, earthquakes (recent 8.3 magnitude earthquake in Chile).

- Technical problems – Commissioning delays, slower ramp-ups, 45% of supply growth is coming from greenfields projects.

- Power shortages – Chile, Zambia.

- Labor activity – Contract revisions, mine, rail and port strikes, environmental protests. Over 15% of production had labor contracts up for renewal in 2015. Workers at some of the world’s largest mines – Freeport McMoRan’s Grasberg in Indonesia and BHP Billiton/Glencore’s Antamina in Peru – were to renegotiate contracts in 2015. Bloomberg, in April, reported almost a 10th of global copper output was at risk of being lost due to labor disruptions in 2015 affecting 1.5 million metric tonnes or 8.2% of annual production.

- Older mines reaching end of mine-life – Falling grades, dirty concentrates (laced with arsenic).

- Declining price environment – Project deferrals, mothballing and downsizing of mine plans.

- Resource Nationalism – Resource nationalism is the tendency of people and governments to assert control, for strategic and economic reasons, over natural resources located on their territory ie. Indonesian ban on unrefined ore exports.

- Exports from Indonesia’s Grasberg copper mine will be affected by a “lack of water in rivers to transport the metal to the port”.

- Electricity shortages in Zambia are also expected to weigh on supply. As water levels at its hydropower dams dried up after a drought last month, the country’s power providers announced a 30% reduction in supply to mines.

- The low-hanging mineral fruit has been picked

- Metallurgy is becoming more complicated

- We are using more and more energy to achieve the same amount of production. When does one unit of cost in, not give you the two out you need?

- There is no substitute for many metals except other metals – plastic piping is one exception

- There hasn’t been a new technology shift in mining for decades – heap leach and open pit mining come to mind but they are both decades old innovations

- Increasingly we will see falling average grades being mined, mines becoming deeper, more remote and come with increased political risk

- Labor shortages loom, baby boomers are starting to retire en masse, and the resource-orientated talent pool is thinning out

- We’re rushing headlong into shortages of resources and the conflicts generated from a lack of security of supply

- Slowing production and dwindling reserves at many of the world’s largest mines

- The pace of new elephant-sized discoveries has decreased in the mining industry

- All the oz’s or pounds are never recovered from a mine – they simply becomes too expensive to recover

- Increased sensitivity and specificity for the detection of cancers and even premalignant lesions.

- A potential decrease in cancer recurrence due to the ability to completely remove tumor tissues along with the cancerous cells in the margins.

- A significant commercial advantage to BSS’s imaging technology because of its adaptability to all endoscopes that are currently on the market.

- Easy adoption of BSS’s two ultrasensitive imaging designs for use in multiple other applications where endoscopy imaging is currently utilized.

- Medical advances lessened the mortality rate in many countries

- Massive increases in agricultural productivity caused by the “Green Revolution”

- Development of high yielding varieties of cereal grains

- Expansion of irrigation infrastructure

- Modernization of management techniques

- Mechanization

- Distribution of hybridized seeds, synthetic fertilizers, and pesticides to farmers

- Agricultural output did increase as a result of the Green Revolution, but the energy input to produce a crop increased faster – the ratio of crops produced to energy input has decreased. This is because High Yielding Varieties (HYVs) of seeds only outperform traditional varieties when adequate irrigation, pesticides and fertilizers are used

- Green Revolution agriculture produces monocultures of cereal grains. This type of agriculture relies on the extensive use of pesticides because monoculture systems – with their lack of genetic variation – are particularly sensitive to bug infestations

- The transition from traditional agriculture to GR agricultural meant farmers became dependent on industrial inputs – not made on the farm inputs. Farmers faced severely increased costs because they now had to purchase such items as farming machinery, fertilizer, pesticides, irrigation equipment and seeds

- The increased level of mechanization on larger farms removed a large source of employment from the rural economy. New machinery – mass produced gas tractors, large self propelled combines and mechanical cotton pickers – all combined to sharply reduce labor requirements

- Less people were affected by hunger and died from starvation – but many more are affected by malnutrition such as iron or Vitamin A deficiencies. Green Revolution grains do not have the same nutritional values as traditional varieties. The switch from heavily rotated multiple crops to mono cropping or dual cropping reduces total soil fertility and the nutritional value of our food

- The Green Revolution reduced agricultural biodiversity by relying on just a few varieties of each crop. The food supply could be susceptible to pathogens that cannot be controlled by agrochemicals

- Many valuable genetic traits, bred into traditional varieties over thousands of years, are now lost

- Wild plant and animal biodiversity was hurt because the Green Revolution expanded agricultural development into new areas where it was once unprofitable or too arid to farm

- The 20/80 phenomenon – the rapid increase in farm size and the concentration of production among large producers means 20% of producers generate 80% of the agricultural output

- As a result of modern irrigation practices, aquifers in places like India and the US mid west have become depleted. There are two types of aquifers: replenish able, most of the aquifers in India and the shallow aquifer under the North China Plain are replenish able – depletion means the maximum rate of pumping is automatically reduced to the rate of recharge. For fossil, or non-replenish able aquifers – like the U.S. Ogallala aquifer, the deep aquifer under the North China Plain, or the Saudi aquifer – depletion brings pumping to an end. In the more arid regions like the southwestern United States or the Middle East the loss of irrigation water could mean the end of agriculture in these areas

- Green Revolution techniques rely heavily on chemical fertilizers, pesticides and herbicides, some of these are developed from fossil fuels which makes today’s agriculture regime much more reliant on petroleum products

- Farming methods that depend heavily on chemical fertilizers do not maintain the soil’s natural fertility and because pesticides generate resistant pests, farmers need ever more fertilizers and pesticides just to achieve the same results

- The increased amount of food production led to overpopulation worldwide

- Agriculture

- Energy

- Water use

- Manufacturing

- Disease control

- Fertilizers

- Information management

- Transportation

- Global abnormal weather. Record setting droughts, flooding, hailstorms, cold snaps all exacerbated by climate change

- Exploding populations

- Eastern diets shifting to a western style one and food to fuel

- Aquifers are being depleted faster than natural refreshment rates

- Desertification

- China – 9,233

- Indonesia – 4,956

- Philippines – 4,410

- India – 3,876 Pakistan – 2,891

- Pakistan – 2,891

- For over the last twelve years supply has struggled to keep pace with demand

- Metal supply is finite and subject to compounding demand from developing nations

- Metal production is highly cyclical, with intermittent peaks and troughs which are closely linked to economic cycles – declining production has historically been driven by falling demand and prices, not by scarcity

- Rates of production and amounts of reserves continually change in response to movements in markets and technological advances

- Most mineral resources will not be exhausted in the near future

- If energy was cheap and unlimited then recoverable resources would be unlimited

- Discovery and development is increasingly becoming more challenging and expensive

- Average ore grades are in decline for most minerals, yet production has increased dramatically

- Our most important metals are suffering from declining ore quality and rising extraction (ore is a different and inferior chemical or structural composition) costs

- Our prosperity has always been based on the fact that producing resources yielded more resources than it cost. However the cost of *energy is climbing, the amount used is climbing but the returns from energy expended is declining. Eventually the quantity of resources used in the extraction process will be 100% of what is produced

- Most older existing mines, the foundation of our supply, have increasing costs with production rates stagnating or even declining

- The rate of discovery is not keeping pace with the rate of depletion, let alone being higher

- Location

- Capital and operating costs

- Market conditions

- Average capital and operating costs for copper production capacity in new mines increased an average of 15% per year over the past 20 years

- From 2001 to 2012, the weighted-average head grade at 47 producing mines with comparable data declined by almost 30%

- The average ore grades of copper in new discoveries and developing projects is declining

- Significant deposits are now being found at greater depths or in more remote areas

- Net of administrative costs, a mining company had an average total cost to replace reserves and produce copper of more than $3.30/lb in 2012

- The 22 major copper producers, based on 2012 production levels, need to replace an average of at least 500,000 mt of copper reserves each year

- An increasing proportion of potential new supply is located in riskier countries.

- More challenging environments subject to a lack of infrastructure imply an increase in the capital intensity of new projects.

- Recent supply has continued to underperform with decreasing grades and disruptions impacting production.

- Major causes of supply disruption will continue, these causes being; Technical complexity, Project delays, Labor strike action

- Rising energy and commodity prices

- A decline in the global economy

- Civil unrest

- Global energy demand is expected to grow by 37% by 2040.

- Electricity demand is expected to increase by almost 80% over the same period with some 7,200 gigawatts (GWe) of capacity needing to be built to keep pace with increasing electricity demand and fleet retirements.

- Energy demand growth will be led by China until the mid-2020s, with India then replacing China as the main energy consumer out to at least 2040.

- The Megatons to Megawatts program supplied around 10% of all US electricity over the past 15 years.

- The Megatons to Megawatts program supplied 12% of world uranium demand.

- The timing couldn’t be better. I do not consider this a ‘today deal.’ I look at the merger being done today as building for tomorrow the largest integrated uranium production company focused solely on the United States

- The uranium market is facing a dramatic supply risk due to low market prices. Analysts are saying the uranium market must recover to $75-$80/pound to incentivize the development of new uranium projects.

- The existence of long-term sales contracts provides downside protection

- The combined entity has the ability to ramp up production from its existing project portfolio quickly

- A land-based RadonEX survey. Some of the Athabasca Basins highest RadonEx readings (9.93 pCi/m2/sec) were generated by LK’s Gibbons Creek survey. These readings are 10 times higher then what Fission Uranium Corp. measured at their Patterson Lake discovery. A very interesting fact associated with this survey is that radon gas associated with uranium mineralization has a half-life of 3.8 days, 80% decays within 12 days and within 30 days it has 100% disappeared.

- Ground work confirmed the existence of the historic radioactive boulder field with eight samples surpassing 1% U3O8, one of them hitting 4.28%. Another 11 samples assayed above 0.2%, with nine more below 0.2%. Anomalous values for nickel, arsenic, lead and cobalt also appeared. Samples taken from glacial till down ice show results as high as 5% uranium

- A DC-Resistivity survey confirmed the definition of an east-west resistivity low, this low has been interpreted as an alteration corridor.

- Surface sampling at the Star Uplift, a basement outcrop about 350 meters by 700 meters, found a gold trend that also revealed platinum group elements, rare earths and anomalous low-grade uranium. Of 124 soil samples, 29 exceeded 0.1 g/t gold. Six of them passed 1 g/t and one reached 2.21 g/t gold. Of 73 rock samples, nine assayed over 0.1 gram per tonne gold, including two that surpassed 2 g/t and one that hit 3.7 g/t gold. There�s also up to .75 of a gram per tonne platinum and palladium in the samples.

- One kilometer south of the Star uplift there’s a massive alteration zone showing up in the resistivity data set. The periphery of the zone was drilled in the 1970s. Assays returned up to 1,500 parts per million uranium – that’s 1,500 ppm proximal to a massive alteration zone.

- In the Athabasca Basin pathfinder elements – gold and Platinum Group Element (PGE) would be included in this group – are usually counted in parts per million. To be counting gold and PGE in grams per tonne is highly unusual, although Shea Creek and Patterson Lake South did have high grade gold values.

- The property was covered by airborne EM surveys and airborne gravity surveys in 2006. There’s also a very good set of historic data – during the 1976-1981 exploration boom Eldorado Nuclear Ltd. completed soil sampling, prospecting, ground EM surveys, gravity surveys and resistivity surveys.

- There’s a major regional structural lineament running 30 to 40 kilometers north to south. Every significant uranium deposit is structurally related – there has to be a fault zone or a structure of magnitude. Having it reactivated time and time again allows multiple generations of fluid to flow along that structure and deposition of perhaps multiple high grade ore bodies.

- The deposits in the Athabasca Basin are considered blind deposits there’s no surface expression so one of the major keys to success is maximizing the number of holes drilled. Shallow depth – it’s just 50 to 250 meters to the sub-Athabasca unconformity on Lakelands Star/Gibbons project – leads to cheaper drilling per hole. More holes equals more exploration bang, more chances of success for the buck.

- Roads and power lines cross the property which lies only a few kilometers from the town of Stony Rapids. When everything is taken into consideration it’s easy to see why Lakeland anticipates an economical program of shallow drilling.

- The company is in receipt of the necessary permits to carry out the work program, a drilling contract has been negotiated and the company is fully funded to complete the work. The drill program will commence as soon as winter ground conditions permit.

- An option to acquire up to a three percent NSR royalty (by December 2016) on claims covering the majority of the currently outlined Spring Valley gold deposit – Outlined inRED hatching on map above.

- A total of up to a one percent NSR royalty on the remaining portion of the currently outlined Spring Valley gold deposit as well as areas to the north of the currently outlined NI 43-101 gold resource – Outlined in GREEN hatching on map above. Terraco currently has direct ownership of 0.5 percent NSR royalty plus an option (by December 2016) to purchase an additional 0.5 percent NSR royalty for a total of up to one percent NSR royalty.

- Terraco has a Right of First Refusal (ROFR) for a one percent NSR royalty on claims within a one-half (1/2) mile perimeter area of interest around the claims in RED.

- A substantial upward trend in real interest rates will soon begin.

- In a strengthening economy.

- In a future where there is no inflation.

- Announce an inflation or price-level target that guarantees a period of above-normal inflation.

- Depreciate the currency.

- Support the depreciation, to the extent necessary, through direct intervention in foreign-exchange markets: print money and buy foreign currencies or assets.

- Higher demand for U.S. Treasuries – rising bond prices means falling interest rates.

- Lower borrowing costs for the Federal government – which is good, 47 percent of U.S. households receive some kind of government dependency check each month. The U.S. spent $2 trillion last year in handouts.

- Foreign demand for U.S. assets, primarily domestic large-cap stocks.

- A stronger dollar makes U.S. exports more expensive and hurts U.S. based international corporation profits whose international earnings will be savaged. A five percent rise in the dollar versus the euro results in a drop of about $1 for full-year Standard & Poor’s 500 Index per-share earnings – that is going to effect the stock markets immensely.

- The dollar rose 7.8 percent against the euro last quarter and 6.7 percent against a group of 10 currencies. According to U.S. Commerce Department exports from Italy to the U.S. are up 10.2 percent this year through August, German exports to the U.S. rose 10.7 percent, and French shipments climbed 6.5 percent.

- A dollar that is appreciating strongly against other currencies is a drag on U.S. growth – foreign goods are cheaper, U.S. exports are more expensive meaning the U.S. trade balance is going to deteriorate.

- Goldman Sachs says the dollar’s rise could reduce real gross domestic product growth by 0.1 to 0.15 percentage point in 2015 and 2016.

- Deficits are going to rise – war fighting isn’t cheap. Air power alone isn’t enough to win against the Islamic State and ‘boots on the ground’ will be necessary – that’s expensive. The cost of continual war is going to escalate drastically.

- Lower commodity prices – cheaper input costs will produce less or none of the much wanted inflation.

Bond market bear creating gold bull

January 19th, 2018By Richard Mills.

Gold is climbing as bond yields rise and the dollar falls, over speculation that China is pulling back on buying US Treasuries and Japan signals it is winding down its quantitative easing program. Meanwhile, US debt continues to grow after the Republicans under President Trump pushed a trillion dollars worth of tax cuts through the Senate, that the Congressional Budget Office thinks will add $1.7 trillion to the deficit over the next decade.

It’s all good news for gold which thrives on the spectre of high government debt leading to more money-printing (aka the Federal Reserve buying Treasuries) and inflation.

Today’s Federal Debt is $20,493,401,574,964.07.

The amount is the gross outstanding debt issued by the United States Department of the Treasury since 1790 and reported here.

But, it doesn’t include state and local debt.

And, it doesn’t include so-called “agency debt.”

And, it doesn’t include the so-called unfunded liabilities of entitlement programs like Social Security and Medicare.

Federal Debt per person is about $62,805.

Inflation, of course, diminishes the value of the currency and hikes gold prices, since the US dollar and gold normally move in opposite directions.

Gold is seen as a hedge against inflation.

Consumer prices in the United States increased 2.1 percent year-on-year in December of 2017… Figures came below market expectations of 2.2 percent amid a slowdown in gasoline and fuel prices. Still, core inflation edged up to 1.8 percent and the monthly rate increased to 0.3 percent, the highest in eleven months. tradingeconomics.com

China Treasury purchases in doubt

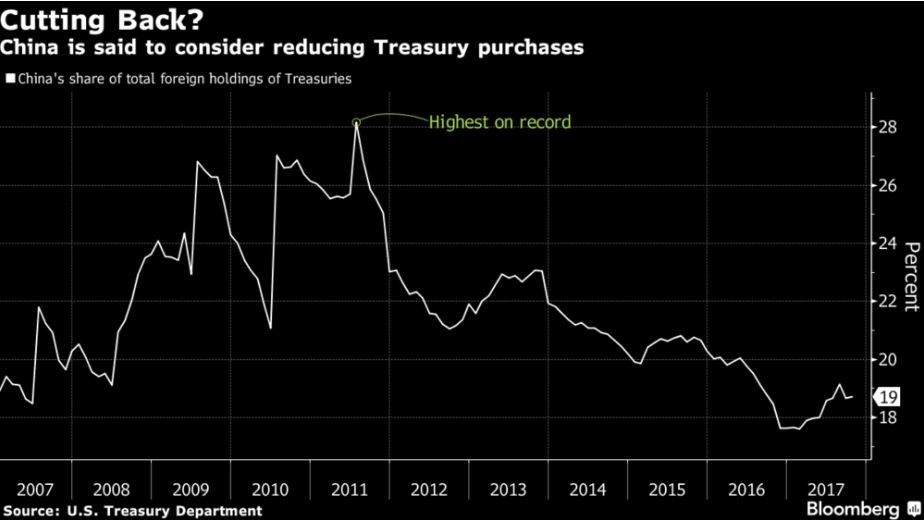

Last week was very interesting for the bond markets which are a key determinant of the US dollar and therefore gold prices. On Friday, January 12, spot gold hit $1,337.40, having enjoyed a three-day run of $21.40 following an announcement from the Chinese that they could either slow or halt their purchase of US Treasuries. China holds $1.3 trillion worth of US debt, the most of any country.

The Chinese buy Treasuries – effectively lending money to the US government – so that the US can keep buying Chinese goods and China can keep selling their products, earning enough dollars to convert into Chinese yuan to pay workers and suppliers. The People’s Bank of China buys US dollars from exporters, accumulating large forex reserves, and sells them yuan, to keep the dollar higher against the yuan. This gives China a competitive trade advantage.

From November 2016 to November 2017 China’s trade surplus with the US was $416 billion, with the bulk of those earnings in US dollars, South China Morning Post pointed out in an editorial on Monday. Exports rose 10.9% in December.

Whether or not the Chinese follow through (officials later denied the rumour), bond investors got spooked at the prospect of the world’s largest T-bill holder losing faith in US debt, and by extension, the US economy. A large selloff ensued, with the 10-year US Treasury bill hitting its highest yield in 10 months at 2.59% (bond prices and yields are inversely related: when prices drop, yields go up).

The move up was also influenced by the Bank of Japan, which on Jan. 9 trimmed its purchases of Japanese bonds by about $20 billion. The Japanese cutback fueled speculation that the BOJ would end quantitative easing, just as the Federal Reserve did last September; the yen rose immediately by half a percent, as did Japanese bond yields.

Gold-bond yield correlation is weak

While rising bond yields are typically bad for gold, since they increase the opportunity cost of owning gold which pays no income for holding the metal, the present lift in gold prices, even though bond yields are rising, means the correlation is weaker than normal, according to analysts quoted by Kitco.

The head of commodity strategy at TD Securities said that gold is benefiting from uncertainty given that the US dollar is weaker as bond yields push higher.

“This tells me that markets don’t have a lot of confidence in the U.S. at the moment,” [Bart Melek] told Kitco. Vince Lanci, founder of Echobay Partners, said that the fact that gold can rally in a higher bond environment is further proof that the yellow metal has entered a new phase of its bull market. “China buying or not buying Treasuries in the short term is not the big factor… the fact that gold rallied on it means the path of lesser resistance, for now, is up,” he said.

A bear market in bonds

Still, the fact that bond yields are rising is a strong signal to gold investors that: 1/ the demand for US Treasuries is falling and 2/ that the stage is being set for a higher inflationary environment which would mean higher interest rates and increased stock market volatility.

According to a 2017 report from Bank of America Merrill Lynch, when gold prices and bond yields rise in tandem, the stock market tends to move the other way. The report notes both the stock market crashes of 1973 and Black Monday in 1987 were preceded by three quarters of rising bond yields and rising gold. That’s because when both investment vehicles rise, it signals higher inflation, and that leads to rises in interest rates, which are generally bad for stock markets. When stock markets fail, investors turn to more concrete safe havens Ie. gold.

Coupling the current 10-year benchmark Treasury rise, with the fact that a slew of maturing government debt hit the market last week – $32 billion of 10- and 30-year US bonds were sold, along with 4 billion euros of German bonds – “bond King” Bill Gross declared a bear market for bonds. Quotes Bloomberg:

“Bond bear market confirmed,” Gross said in a Twitter posting [last] Tuesday, noting that 25-year trend lines had been broken in five- and 10-year Treasury maturities. The billionaire fund manager at Janus said last year that 10-year yields persistently above 2.4 percent would signal a bear market…

What about inflation?

Bonds tend to sell off when investors believe that more inflation is coming. That’s because the yield gets eaten away by inflation (Eg. you own a 10-year Treasury bill that pays 3%. If inflation is 2%, your real return is only 1%.)

Data last Friday showed that US inflation is now above 2%, with most analysts believing that more rate hikes (an anticipated three more interest rate rises by the Fed this year) have been priced into the inflation rate. Rates could even go higher. In a Wall Street Journal article, Boston Fed President Eric Rosengren said he expected “more than three” rate hikes in 2018 because it wants to get ahead of inflation and not tighten too quickly.

The rise in the two-year Treasury bill – the benchmark Treasury most sensitive to Federal Reserve rate hikes – pushed above 2% last week for the first time since the collapse of Lehman Brothers in 2008, the start of the financial crisis.

The two-year note now provides more income than dividends on the S&P 500 Index. Could this be the harbinger of the next stock market crash?

More debt will hike interest rates, sink the dollar

Meanwhile the elephant in the room is the ballooning US debt. In under a decade, mostly under the Obama Administration, the amount of debt doubled from US$10 trillion to $20 trillion. The chief economist at Goldman Sachs recently revised his deficit projections from below $500 billion in 2018 to over $1 trillion in 2019 due mainly to the Trump tax cuts which will require an additional $200 billion in each of the next four years. How will Congress get the funds? By issuing more Treasuries. Goldman expects net borrowing to go from $488 billion in 2017 to $1.03 trillion this year, and the same amount in 2019. Importantly, under this forecast the debt to GDP ratio rises from 3.7% in 2018 to 5% in 2019, which increases borrower risk. To compensate, and attract T-bill buyers, the Fed is likely to offer higher interest rates. ZeroHedge quotes future Fed chair Jay Powell predicting that is exactly what is going to happen, in a 2012 Fed meeting:

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that is our strategy.”

The “big losses” Powell refers to “down the road”, which is actually now, is the extra interest the US government will be forced to pay on its Treasury bills, as the yield curve continues to climb. This will start a vicious cycle that goes something like this: Higher interest rates boost the cost of borrowing for businesses and individuals, thereby slowing the economy. This necessitates more government borrowing, thus pushing up the debt to GDP ratio which makes US T-bills more risky and less attractive to investors. If demand for Treasuries drops, so will the dollar, meaning foreign bond holders get paid in US dollars that are worth less, further slowing demand for them. Finally, as the dollar continues to fall, the US government will have to pay exorbitant amounts of interest on the Treasuries upon maturity, increasing its risk of defaulting on the loans once they become due.

From this brief analysis, it’s easy to see that debt is good for gold. Bullion investors don’t have to worry about the government defaulting on the piece of government debt they own, nor should they be concerned about the value of the currency falling when the T-bill plus interest matures. As long as the gold is in the form of physical metal bullion it’s a safer bet than a T-bill.

Dollar is withering

In a recent post I wrote about how China is hoping to reduce the hegemony of the US dollar, which most commodities are priced in, through the launch of a new oil futures contract. The yuan-denominated oil futures will allow exporters like Russia and Iran to buy and sell their oil through China, thus avoiding US economic sanctions and circumventing the US dollar. Moreover, the yuan will be fully convertible into gold on exchanges in Shanghai and Hong Kong.

This is just the latest move on behalf of China to usurp the economic might of the United States. Between them, Russia and China are moving to kill the dollar. If that ever happens, it will make US-Chinese military conflicts in the South China Sea look like petty squabbles.

At the end of 2015 the Russian Central Bank made the yuan an official reserve currency, and in 2017, the RCB opened its first office in Beijing. The closer cooperation was a result of US sanctions on Russia after the crisis in the Ukraine, and the oil price slump that hit the Russian economy. The two countries have also issued government bonds denominated in each other’s currencies, which are designed to compete with US Treasuries.

Since then trade between Russia and China has been increasing, following in the footsteps of landmark energy deals that have taken place over the last decade. These include the $456 billion gas deal that Russian state-owned Gazprom signed with China in 2014, a $25-billion oil swap agreement Russian oil giant Rosneft signed with Beijing in 2009, and a doubling of oil supplies from Rosneft to China in 2013, valued at $270 billion.

Russia and China are also increasingly sharing technology with possible military applications. The US Congress’ US-China Economic Security and Review Commission reported the export of Russian aerospace technology to China was “challenging US air superiority and posing problems for US, allied, and partner assets in the region.”

Another interesting development is the joint trade in gold between China and Russia. The idea is to create a link between the two gold-trading hubs, Shanghai and Moscow, in order to facilitate more gold transactions.

“In other words, China and Russia are shifting away from dollar-based trade, to commerce which will eventually be backstopped by gold, or what is gradually emerging as an Eastern gold standard, one shared between Russia and China, and which may one day backstop their respective currencies.”

Sound familiar? What they’re talking about is the kind of monetary system that existed before the 20th century – when banks were constrained in their loans by how much gold was in their vaults. The US went off the gold standard in 1971, thereby severing the linkage between the world’s major currencies and gold. Soon afterward, the US dollar became the leading reserve currency.

Trade conflicts: throwing fuel on the fire

While President Trump under his “Make America Great Again” banner has pressured key trading partners including China, Canada and Mexico, the reality is that passing protectionist measures and ripping up existing trade agreements like NAFTA is likely to depress the dollar – further alienating foreign investors who would otherwise flock to the greenback, and hurting the US economy to boot.

For example during NAFTA negotiations last fall, currency strategist Jens Norvig was asked what would happen should NAFTA fall apart. The result he said would not only be dramatic declines in the values of the Mexican peso and the Canadian dollar, but also appreciation of the yuan and the euro versus the dollar.

“In fact, I think over the medium-term, [euro] and [Chinese yuan] would benefit from the U.S. “America First” policy, as it has to make the [dollar] a less attractive reserve currency,” CNBC quoted Nordvig saying. The benefactor, again, will be gold.

Conclusion

Gold rose 12.5% in value last year, shaking off US rate hikes, the frenzied introduction of bitcoin, and record-setting highs on the Dow and S&P 500 exchanges. While some investors have exited the precious metals space to chase alternative realities, aka the crypto world, gold has been, and will continue to be, a solid investment especially during times of economic and political upheaval when the metal functions as a safe haven.

Are there other basic, more fundamental reasons to buy gold? Well, read this excellent article from Bloomberg, ‘Disastrous’ deals sideline gold-mining M&A as metal rises’ posted on MINING.com.

For those who follow economic trends, the latest turbulence in the bond markets is a pretty bullish signal for gold. While there will be daily fluctuations, the short term trend seems to be one of a sustained rally, especially if bond yields continue to rise and the dollar keeps slumping.

The correlation between the bond markets, the dollar and gold is an important determinant of future gold prices. These relationships are something every gold investor should track, to determine ideal entry and extra points for both bullion and gold stocks.

I have bond market trends on my radar screen, and due diligence, which I freely share, on exceptional quality gold exploration juniors on my to do list. Do you?

Comments Off on Bond market bear creating gold bull

A Good Time To Be Buying Gold

November 14th, 2016By Richard Mills.

There’s a lot going on in the world – from Trump being elected in the U.S. to turmoil in the middle east, the China Sea and Turkey, Russia is flexing it’s still considerable might, North Korea’s flinging it’s nukes helter skelter, Japan’s rearming, disease runs rampant and fear escalates about virus mutation, there’s shortages of fresh water with many rivers not reaching their former endpoint and of course climate change is rearing its head to destabilize natural rhythms or cycles. It’d be hard to go back in history and pick a period of time when things weren’t so combustible.

Your author believes gold and silver have never been better safe-haven investments. Inflation, world events, diversification – gold and silver bullion do offer investors leverage.

So too do resource related equities. Junior resource companies, financed to near term production, currently offer the greatest leverage to increasing demand and a rising gold/silver price. This is where the money will be made in the next two years.

It’s a fact junior mining companies outperform senior miners at finding new mineral deposits and generating wealth for stakeholders…

“These are among some of the findings released in a study conducted by resource company strategist MinEx Consulting, which analyzed the performance of explorers and producers operating in Canada between 1975 and 2014. What the consultancy firm found is that, in the last decade, junior companies were responsible for more than three quarters of all new mineral discoveries and were approximately 30 percent more effective than senior companies at generating wealth.”

Aheadoftheherd.com’s editor isn’t looking for huge producers with so much overhead that they can’t profitably mine an ounce of gold. I’m not looking at huge mines with billions and billions of dollars in capex. I’m much much more comfortable with smaller mines having lower capex and under-control operating expenditures.

If you want to invest in the building of something of value – be there as the company moves it’s mineral deposit down the development path towards a mine there are a very few quality junior companies to choose from. Even fewer with the studies done and money already raised to get into production.

These are the situations that are an enormous opportunity to back excellent management teams with your investment money.

Spending

Let’s look at why companies aren’t making a profit:

-One of the biggest reasons is capital expenditures (capex), which is the basic cost of building a mine and its supporting infrastructure.

-There are lower grades being mined and more complex metallurgy.

-Companies are increasingly going into more remote areas that lack infrastructure.

-Environmental regulations are increasing.

-We are seeing more money-grabbing governments and resource nationalization. Miners are an easy target as mining is a long term investment and one that is especially capital intensive – mines are also immobile, so miners are at the mercy of the countries in which they operate. Outright seizure of assets happens using the twin excuses of historical injustice and environmental/contractual misdeeds. There is no compensation offered and no recourse.

Because everything you can imagine is working in a perfect storm to increase costs, and risks, on mining companies, here at aheadoftheherd.com we’re seeking out the smaller mines with low capital costs, uncomplicated metallurgy, no worry of governments seizing our asset and we’re looking in areas with long mining histories.

Northern Vertex mining Corp. TSX.V – NEE

Northern Vertex has activated the historic Moss Mine area (100% owned by NEE) in north west Arizona. With excellent site access – only a 20 minute drive from Bullhead City and its population of 35,000 people there’s excellent infrastructure to support an operational mine and the skilled workforce close by to run it.

The Moss Mine Gold-Silver Project is an epithermal, brecciated, low sulphidation quartz-calcite vein and stockwork system which extends over a strike length of 1,400 meters and has been drill tested to depths of 370 meters vertically.

The Moss mine is a potential heap leach, open pit project that has been advanced to the Feasibility Study stage.

Measured and Indicted oz gold (Au) 377,000.

Measured and Indicted oz silver (Ag) 4,610,000.

The Feasibility Study shows the Moss Mine to be an economically robust, higher margin, lower risk project in one of the world’s premier mining jurisdictions.

Northern Vertex has just signed a US$20,000,000 million credit agreement with Sprott Lending.

Northern Vertex has just signed a US$20,000,000 million credit agreement with Sprott Lending.

With US$8,500,000 in equipment financing under negotiation, US$7,000,000 in the treasury and capital expenses estimated to be US$33,000,000 to build the mine, development of, and production at NEE’s Moss Mine seems to be a certainty.

Exploration potential to further expand the gold and silver resource certainly exists.

Moss Claim Blocks:

The Company has also identified four high priority targets – all four are situated in close proximity to planned operations facility – that will be the focus of a proposed upcoming multi-phase drill program.

Because Northern Vertex is well advanced along the development path towards a mine the guesswork about grade, size, costs and metallurgy have been taken out of the equation for us. Company management has done the work necessary to give investors the confidence that their project will be a profitable mine.

Conclusion

Northern Vertex TSX.V – NEE has raised the dollars needed to get into production, investors can see they are going mining and cash flow is just over the horizon.

Buying already paid for near term gold and silver production in today’s current global climate of fear and uncertainty might not be such a bad idea.

Northern Vertex is on my radar screen, is it on yours?

If not, maybe it should be.

Comments Off on A Good Time To Be Buying Gold

Unknown Voluntary Servitude

August 31st, 2016By Richard Mills.

Here’s a long debated topic. Should we leave the creation of new money in the hands of bankers or place its creation solely with our government?

Let’s try and answer it.

The Creature from Jekyll Island

On the night of November 22, 1910 a delegation of the nation’s leading financiers, led by Senator Nelson Aldrich, left New Jersey for a very secret ten day meeting on Jekyll Island, Georgia.

Aldrich had previously led the members of the National Monetary Commission on a two year banking tour of Europe. He had yet to write a report regarding the trip, nor had he yet offered any plans for banking reforms.

“Despite my views about the value to society of greater publicity for the affairs of corporations, there was an occasion near the close of 1910, when I was as secretive, indeed, as furtive, as any conspirator. . . . Since it would have been fatal to Senator Aldrich’s plan to have it known that he was calling on anybody from Wall Street to help him in preparing his bill, precautions were taken that would have delighted the heart of James Stillman.” Frank Vanderlip, in the Saturday Evening Post, February 9, 1935

Accompanying Senator Aldrich to Jekyll Island were:

After the Jekyll Island visit the National Monetary Commission “wrote” the Aldrich Plan which formed the basis for the Federal Reserve system.

“In 1912 the National Monetary Association, under the chairmanship of the late Senator Nelson W. Aldrich, made a report and presented a vicious bill called the National Reserve Association bill. This bill is usually spoken of as the Aldrich bill. Senator Aldrich did not write the Aldrich bill. He was the tool, if not the accomplice, of the European bankers who for nearly twenty years had been scheming to set up a central bank in this Country and who in 1912 has spent and were continuing to spend vast sums of money to accomplish their purpose.” Congressman Louis T. McFadden on the Federal Reserve Corporation: Remarks in Congress, 1934

After several failed attempts to push the Federal Reserve Act through Congress, a group of bankers funded and staffed Woodrow Wilson’s campaign for President. He had committed to sign a slightly different version of the Federal Reserve Act than Aldrich’s Plan.

In 1913, Senator Aldrich pushed the Federal Reserve Act through Congress just before Christmas when much of Congress was on vacation. When elected president Woodrow Wilson passed the FED.

“Our secret expedition to Jekyll Island was the occasion of the actual conception of what eventually became the Federal Reserve System. The essential points of the Aldrich Plan were all contained in the Federal Reserve Act as it was passed.” Frank Vanderlip, autobiography, From Farmboy to Financier

“I have unwittingly ruined my country.” Woodrow Wilson later said referring to the FED

The Fed

The US Federal Reserve Bank (FED) is a privately owned company (Wikipedia describes the Fed as a complex business-government partnership that rules the financial world) that controls, and profits immensely by printing money through the US Treasury and regulating its value.

“Some [most] people think the Federal Reserve Banks are U.S. government institutions. They are not … they are private credit monopolies which prey upon the people of the U.S. for the benefit of themselves and their foreign and domestic swindlers, and rich and predatory money lenders. The sack of the United States by the Fed is the greatest crime in history. Every effort has been made by the Fed to conceal its powers, but the truth is the Fed has usurped the government. It controls everything here and it controls all our foreign relations. It makes and breaks governments at will.” Congressional Record 12595-12603 — Louis T. McFadden, Chairman of the Committee on Banking and Currency (12 years) June 10, 1932

“… we conclude that the [Federal] Reserve Banks are not federal … but are independent, privately owned and locally controlled corporations … without day-to-day direction from the federal government.”9th Circuit Court in Lewis vs. United States, 680 F. 2d 1239 June 24, 1982.

The FED began with approximately 300 people, or banks, that became owners (stockholders purchased stock at $100 per share) of the Federal Reserve Banking System. The Fed is privately owned – 100% of its shareholders are private banks, the stock is not publicly traded and none of its stock is owned by the US government.

The US government pushed through the Sixteenth Amendment (which exempted income taxes from constitutional requirements regarding direct taxes) restarted an income tax on Americans to pay the interest to the FED and reorganized the IRS to collect the monies – the interest – “owed” to the FED from its citizens.

Sir Josiah Stamp, president of the Rothschild Bank of England and the second richest man in Britain in the 1920s, said the following in 1927 at the University of Texas:

“The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in inequity and born in sin. Bankers own the Earth. Take it away from them but leave them the power to create money, and with a flick of a pen, they will create enough money to buy it back again. Take this great power away from them and all great fortunes like mine will disappear, for then this would be a better and happier world to live in. But if you want to continue to be the slaves of bankers and pay the cost of your own slavery, then let bankers continue to create money and control credit.”

The FED banking system collects billions of dollars in interest annually and distributes the profits to its shareholders – the interest on bonds acquired with its newly-issued Federal Reserve Notes pays the Fed’s operating expenses plus a guaranteed 6% return to its banker shareholders.

The US Congress gave the FED the right to print money at no interest. The FED creates money from nothing, loans it out through banks and charges interest. The FED also buys government debt with money from nothing, and charges U.S. taxpayers interest.

The Grip of Death

“We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it.” Congressman Louis T. McFadden in 1932

“The financial system used by all national economies worldwide is actually founded upon debt. To be direct and precise, modern money is created in parallel with debt…The creation and supply of money is now left almost entirely to banks and other lending institutions. Most people imagine that if they borrow from a bank, they are borrowing other people’s money. In fact, when banks and building societies make any loan, they create new money. Money loaned by a bank is not a loan of pre-existent money; money loaned by a bank is additional money created. The stream of money generated by people, businesses and governments constantly borrowing from banks and other lending institutions is relied upon to supply the economy as a whole. Thus the supply of money depends upon people going into debt, and the level of debt within an economy is no more than a measure of the amount of money that has been created.” Michael Rowbotham, ‘The Grip of Death’

The FED is the only for profit corporation in America that is exempt from both federal and state taxes.

Internal Revenue Service (IRS)

The IRS was restarted within months of the FED’s inception. The roots of the IRS go back to the Civil War when President Lincoln and Congress, in 1862, created the position of commissioner of Internal Revenue (The position of Commissioner exists today as the head of the Internal Revenue Service) and enacted an income tax (the initial rate was 3% on income over $800, which exempted most wage-earners) to help pay war expenses. In 1872, seven years after the war, lawmakers allowed the temporary Civil War income tax to expire.

Congress enacted a flat rate Federal income tax in 1894, but the Supreme Court ruled it unconstitutional the following year because it was a direct tax not apportioned according to the population of each state.

Senator Aldrich was instrumental in the re-structuring of the American financial system through a federal income tax amendment, the 16th – he had originally opposed an income tax as communistic a decade before. The 16th Amendment gave Congress the authority to tax the income of individuals without regard to the population of each State:

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

In 1906 David Graham Phillips wrote a series of articles published in Cosmopolitan claiming that politicians were receiving huge payments from large corporations to argue their case in the Senate. Phillips claimed that the main figures in this scandal was Aldrich and Arthur P. Gorman of Maryland.

David Graham Phillips was murdered on 23rd January, 1911. Two months later Aldrich resigned from Congress.

The Federal Reserve was conceived and given birth by an unholy alliance of American and British bankers. The FED buys U.S. debt with money printed from nothing, then charges U.S. taxpayers interest. The US government pushed through the federal income tax amendment, restarted an income tax on Americans to pay the interest to the FED and reorganized the IRS to collect the monies – the interest – “owed” to the FED from its citizens.

Since the Fed’s creation in 1913 the dollar has lost more than 96% of its value.

Undoubtedly the greatest achievement of the FED has been to transform America from being the world’s foremost creditor nation to the world’s largest debtor nation.

Aldrich’s motto, when questioned about his activities and the reasoning behind them, was to “Admit nothing. Explain nothing.”

Fog the mirror

“Many economists see the power to manipulate policy in reaction to the ups and downs of the economy as the natural evolution of fiscal policy. The purpose of this power is to ward off or lessen financial disasters through keeping rates artificially low or introducing more money into the system, or doing the opposite to rein in inflation during periods of growth.” The Atlantic.

Alan Greenspan was chairman of the Federal Reserve from 1987 to early 2006. Greenspan used monetary policy to ignite one of the longest economic booms in history. Of course booms can soon turn to bust and nowhere was the boom more evident than in the housing industry – the sub-prime crisis collapsed the housing boom just after Greenspan left the Fed.

The Great Recession started in December of 2007 and took a sharp downward turn in September 2008. It was started by the U.S. sub-prime crisis which burst the housing bubble. Businesses failed, consumers lost wealth estimated in the trillions of dollars and economic activity and international trade slowed:

After Fed chairman Greenspan left office, the Federal Reserve, under the stewardship of new chairman Ben Bernanke, started easing monetary policy aggressively. By December of 2008, the federal funds rate was between 0 and 1/4 percent. The Fed had used up its traditional stimulus, all the ‘Creature from Jekyll Island’ had left was the ability to print money so they started throwing cash at everything.

Additional stimulus was injected into the economy by:

Late in 2008 there was a run on ultra safe money market accounts – according to AMG Data Services a record $140 billion was pulled out in one day.

In response to the continuing crisis and a stalling economy the US Federal Reserve initiated Quantitative Easing and Operation Twist.

Quantitative Easing (QE) 1, 2, & 3

In September of 2008 the $1.7 trillion QE1 was started. The Fed purchased mostly mortgage backed securities and established a commercial paper lending facility.

In October of 2010 QE2 started. At $600 billion, QE2 was much smaller then QE1 and its buying was mostly confined to purchasing long term government bonds.

QE1 & QE2 failed to restart the economy and housing market.

Operation Twist

Operation Twist is the Fed’s initiative of buying longer-term Treasuries while simultaneously selling shorter-dated issues in order to bring down long-term interest rates.

By purchasing longer-term bonds, the Fed drives up prices which forces yields down – price and yield move in opposite directions. Selling shorter-term bonds causes their yields to go up because their prices fall. These two actions “twist” the shape of the yield curve, hence the name Operation Twist.

QE3

On September 13, 2012, the Fed announced that it would buy $40 billion a month of mortgage-backed securities until the unemployment rate fell below 6.5 percent, or the expected inflation rate rose above 2.5 percent. In December the Fed added buying $45 billion/month of longer-term Treasury securities per month – QE3 is more than one trillion dollars a year.

In 1Q2013, which comprised the first three months of QE3, the Fed increased the size of its balance sheet by $285 billion, or 9.8 percent.

During the first 3 months of QE3, the Fed increased the monetary base by 10.83 percent.

Incestuous relationships

In July of 2011, I was one of the first to bring to your attention to the incredible fact that the US Federal Reserve had secretly given away $16 TRILLION dollars;

“The first ever GAO (Government Accountability Office) audit of the US Federal Reserve was recently carried out due to the Ron Paul/Alan Grayson Amendment to the Dodd-Frank bill passed in 2010. Jim DeMint, a Republican Senator, and Bernie Sanders, an independent Senator, while leading the charge for an audit in the Senate, watered down the original language of house bill (HR1207) so that a complete audit would not be carried out. Ben Bernanke, Alan Greenspan, and others, opposed the audit.

What the audit revealed was incredible: between December 2007 and June 2010, the Federal Reserve had secretly bailed out many of the world’s banks, corporations, and governments by giving them US$16,000,000,000,000.00 – that’s 16 TRILLION dollars.” Richard Mills, aheadoftheherd.com

It gets worse, much worse, in fact it’s downright incestuous. Let’s do a follow up and see who, besides foreign banks and corporations from Scotland to South Korea, received a large chunk of that money.

But first know this – banks like JP Morgan are some of the largest creditors of the bailed out countries. Instead of having to write off their foreign losses the US Federal Reserve bailouts enabled them to be paid in full.

The Government Accountability Office (GAO) investigates potential conflicts of interest. The GAO did investigate the $16 trillion giveaway and laid out the findings but did not name names. Later those names were released – here’s three of the more shocking cases…

The hands that feed

Below are some of the 18 Fed board members who gave their own banks four trillion dollars:

“The Fed outsourced virtually all of the operations of their emergency lending programs to private contractors like JP Morgan Chase, Morgan Stanley, and Wells Fargo. The same firms also received trillions of dollars in Fed loans at near-zero interest rates. Altogether some two-thirds of the contracts that the Fed awarded to manage its emergency lending programs were no-bid contracts. Morgan Stanley was given the largest no-bid contract worth $108.4 million to help manage the Fed bailout of AIG.” Mises.ca

Parasitic banksters and their political puppets

The financial sector parasites, the banksters and their political puppets, that have historically fed on our society had never been so brazen. The looting of the public treasury is very much in the open – if anyone cares to look – and done with impunity.

This is all happening because our elected politicians do not work for the people, our elected leaders have stuck their snouts deep in the trough of power and self indulgence, representative democracy has been co-opted by big-moneyed interests and political parties represent their establishment not the people’s interests.

“The lending suites that were set up for months and years, beyond the initial crisis point, were focused on how to keep banks profitable, not just how to keep them alive. The banks were able to access emergency lending facilities, or change themselves into bank holding companies overnight, to borrow at next to nothing, and if they chose, lend back to the government at a tidy profit. You didn’t have to think at all to make money. And you didn’t have to worry about that toxic balance sheet, because the government was going to help you grow your way out of it. They will also facilitate mergers to help decimate your competition. The money that the banks borrowed for nothing could have just as easily gone to underwater homeowners. There’s nothing special about the banks except that they know the Fed policymakers personally.” David Dayen, firedoglake.com

Mayer Amschel Bauer Rothschild, founder of the International Banking House of Rothschild said:

“Let me issue and control a nation’s money and I care not who writes the laws.”

The Rothschild brothers, already laying the foundation for the Federal Reserve Act, wrote the following to New York associates in 1863:

“The few who understand the system will either be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

Conclusion

Should we leave the creation of new money in the hands of bankers or place its creation solely with our government?

The answer is solely with the government but with a caveat.

Here’s bubble blower ex Fed chair Alan Greenspan…“If we went back on the gold standard and we adhered to the actual structure of the gold standard as it existed prior to 1913, we’d be fine. Remember that the period 1870 to 1913 was one of the most aggressive periods economically that we’ve had in the United States, and that was a golden period of the gold standard. I’m known as a gold bug and everyone laughs at me, but why do central banks own gold now?”

The following link takes you to an excellent article by Nathan Lewis describing the gold standard system in use during the period Greenspan talks about. A very interesting and eye opening read.

This second link takes you to an article written by Murray N. Rothbard, another excellent read on the history of the gold standard and why we are suffering our current monetary chaos.

“The borrower is servant to the lender.” The Bible

“When you get in debt you become a slave.” Andrew Jackson

The Gold Standard is amenable to today, and it’s certainly preferable to the actions, and consequences, of those who have enslaved us in unknown voluntary servitude.

Imposition of a gold standard should be on all our radar screens. Is it on yours?

If not, maybe it should be.

Comments Off on Unknown Voluntary Servitude

Getting A Heartbeat

May 17th, 2016By Richard Mills.

As a general rule, the most successful man in life is the man who has the best information

PricewaterhouseCoopers LLP (PwC) has recently released their 48th annual British Columbia Mining Report.

We all know commodity prices have been on a downward trend for the past five years. We also know several mines in the province have been put on care and maintenance and many early stage projects have seen their funding dry up.

Let’s take a look at some of the stats in PwC’s B.C. mining report:

and one more in early 2016.

$338 million in 2014.

The Association for Mineral Exploration British Columbia (AME BC) report, Framing the Future of Mineral Exploration in British Columbia is an overview about:

Let’s focus on the decreasing land base for a moment. In 1977, 4% of the land base in British Columbia was closed to mineral exploration; today over 18% is closed. Access to another 33% of the land base is severely limited.

Discovering hidden mineral deposits requires access to large tracts of land to explore, but the actual land used for mining purposes is just 0.05% of British Columbia, of which more than 40% is under reclamation.

(1)

“Between 1927 and 1967, Cominco explored more than 1,000 properties in Canada. Of these, only 78 were of sufficient interest to warrant a major exploration program. Sixty were found to contain insufficient ore to justify production; 18 were brought into production, but of these, 11 were not sufficiently profitable to permit recovery of the original investment. Only seven of the original 1,000 properties became profitable mines. During that 40-year period, the company spent more than $300 million in its search for new mines.” Ken Sumanik, Potential impact on mining

Try and imagine the success rate, and cost, of trying to duplicate what Cominco did over half a century ago using today’s dollars and considering the low hanging mining fruit has been mostly picked.

“On average, a prospect will reach development stage between 15 and 20 years after discovery. In many cases, it takes years longer. The mines currently in production in BC, and those in the environmental assessment process, are a direct result of successful discoveries made through prospecting and exploration work conducted in the past, much of it decades ago. Very few grassroots exploration projects reach the advanced development stage, but each exploration program creates value to British Columbians through community and regional development and by increasing the region’s geological knowledge.” AMEbc