Liquidity Glut, Infrastructure Finance Drought and Development Banks

By Otaviano Canuto.

The world economy faces huge infrastructure financing needs that are not being matched on the supply side. Emerging market economies, in particular, have had to deal with international long-term private debt [...]

Underwriting the Next Housing Crisis

By Peter J. Wallison.

WASHINGTON — SEVEN years after the housing bubble burst, federal regulators backed away this month from the tougher mortgage-underwriting standards that the Dodd-Frank Act of 2010 had directed [...]

Welcome to the World of Volatility

By Steve Hanke.

My last column “Regime Uncertainty Weighs on Growth” (October 2014) stressed that market participants do not know what the Big Players (Read: governments and central banks) will do next. This regime uncertainty [...]

Why the Feds Won’t Confiscate Your Retirement Plan… But They Will Do This

By Mark Nestmann.

Over the last few weeks, I’ve had close to 30 consultations with Nestmann Group clients. And one of their top concerns is that Barack Obama or some future US president will find a way to confiscate [...]

History does not always repeat itself, even as a farce!

By Dr. George Kiourktsoglou.

The umbilical cord that connects the notoriously inelastic global crude oil markets to geopolitics is beyond any reasonable doubt. All-out wars, ‘colour revolutions’, insurgencies, even minor [...]

Puerto Rico: Don’t Believe the Hype

By Mark Nestmann.

Unlike many other advisory services, we take a historical perspective when it comes to supposedly fresh and new ideas.

And it’s for that reason that I’ve been skeptical of the tax incentives [...]

Why the Economy is Still Failing Most Americans

By Robert Reich.

I was in Seattle, Washington, recently, to congratulate union and community organizers who helped Seattle enact the first $15 per hour minimum wage in the country.

Other cities and states should follow Seattle’s [...]

SEC’s new rules give US money market funds a floating feeling

By Robert Pozen and Theresa Hamacher.

After years of heated debate, the Securities and Exchange Commission, the US regulator, recently adopted stricter rules for US money market funds. The new rules are intended to limit the potential systemic [...]

Barrick Comes Home

By Richard (Rick) Mills.

As a general rule, the most successful man in life is the man who has the best information

As part of his plan to prevent a run on the dollar, stabilize the US economy, and decrease US unemployment [...]

Can Europe Balance Defense and Economics?

By Julian French.

Rome, Italy. 16 October. Cardinal Richelieu, that great sixteenth century French homme d’état once said, “Rulers are the slaves of their resources”. In 1979 the Italian economy surpassed that of Britain. [...]

Zero bound only game in town

By Richard Mills.

The Federal Reserve tried to fix the U.S. economy by Quantifornication – stimulus measures.

Investors reacted to the Fed’s unconventional efforts. Since the U.S. dollar is the world’s reserve currency and [...]

The Fourth Central Bank Gold Agreement

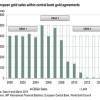

By Julian Phillips.

On 19th May 2014, the European Central Bank and 20 other European central banks announced the signing of the fourth Central Bank Gold Agreement. This agreement, which applies as of 27 September [...]

Market movement

By Paul Nolte.

Housing prices continue to recover from their severe lows of 2009-2010, although foreclosure activity remains an issue in getting housing prices back to “normal”. Mortgage rates remain very close to historically [...]

Bulgaria’s October 5th Elections: A Flashback at the Economic Records

By Steve Hanke.

Bulgarians will go to the polls on October 5th to elect new members of its parliament and thus a new government. Before casting their votes, voters should reflect on the economic records of Bulgaria’s [...]

A Stop Spike Event

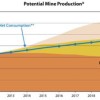

By Richard (Rick) Mills.

As a general rule, the most successful man in life is the man who has the best information

Population growth reports say we can expect, barring WW lll or a virus like Ebola going airborne, [...]

What Does a Porn Star Have to Do With Your Bank Account?

By Mark Nestman.

Recently, The Economist reported that Chase Bank closed the accounts of hundreds of porn stars.

Among them was blond bombshell Teagan Presley, star of Just Over 18 #10 and more than 70 other porn videos. [...]

Who’s Afraid of Deflation?

By David Andolfatto.

Everyone knows that deflation is bad. Bad, bad, bad. Why is it bad? Well, we learned it in school. We learned it from the pundits on the news. The Great Depression. Japan. What, are you crazy? It’s bad. [...]

Middle East and North Africa: A Fatal Attraction

By Steve Hanke.

Last week, President Obama addressed the nation to proclaim that the U.S. and an unspecified coalition were going to once again ramp up our military operations in Middle East and North Africa (MENA). This time, the [...]

The Latest Twist in a Regulatory Sham

By Peter Wallison.

The Financial Stability Oversight Council announced last week that it had preliminarily designated MetLife, the nation’s largest life insurer, as a systemically important financial institution, [...]

Wall Street Admits That A Cyberattack Could Crash Our Banking System At Any Time

By Michael Snyder.

Wall Street banks are getting hit by cyber attacks every single minute of every single day. It is a massive onslaught that is not highly publicized because the bankers do not want to alarm the public. [...]