Excess reserves and inflation risk: A model

By David Andolfatto.

I should have known better than to reason from accounting identities. But that’s basically what I did in my last post and Nick Rowe called me out on it here. So I decided to go back and think through the [...]

Quite the Quagmire 8.27

By David Dock Treece.

We, like many others, have been watching the increasing turmoil in the Middle East, contemplating the effects recent events have been having the financial markets, as well as their political implications. [...]

Africa: The Good, the Bad and the Ugly

By Steve Hanke.

Last week, President Obama hosted the U.S.-Africa Leaders Summit in Washington, D.C. He welcomed over 40 African heads of state and their outsized entourages to what was a festive affair. Indeed, even the Ebola virus [...]

Debt: The First 5000 Years

By David Andolfatto.

Ah, the airport bookstore. As monetary theorist and history buff, I could not resist this tantalizing title: Debt: The First 5000 Years. The book is authored by anthropologist David Graeber, a leading [...]

The Tip Culture in Amateur Investing

By David Merkel.

A reader wrote to me and said:

I’m sure a lot of people have already told you but I want to tell you anyway: Your blog is awesome! I came across The Aleph Blog a couple of months ago and I’m very impressed with your content. [...]

Market watch

By Paul Nolte.

With the various “skirmishes” around the world, it feels as though “we’re on the eve of destruction”. While the song was written nearly 50 years ago, it seems rather poignant today. Others [...]

Three countries to emerge from Iraq as we know it now!

By Julian Phillips.

In the last few weeks the story of Iraq has faded from the headlines to be replaced by the story on the Ukraine, Gaza and on the business front the tumble of the Dow on the New York Stock Exchange.

But [...]

Four Years of Dodd-Frank Damage

By Peter J. Wallison.

The financial law has restricted credit and let regulators create even more too-big-to-fail companies

When the Dodd-Frank Wall Street Reform and Consumer Protection Act took effect on July 21, 2010, it [...]

Reflections on the Misery Index

By Steve Hanke.

Recently, I calculated misery index scores for 89 countries (see: Globe Asia May 2014). For any country, a misery index score is simply the sum of the unemployment, inflation and bank lending rates, [...]

Yellen hints at detrimental Fed action

By David Dock Treece.

Over two days of Senate hearings, Federal Reserve Chairwoman Janet Yellen addressed a number of questions and concerns related to U.S. monetary policy and potential impacts on our economy and financial [...]

Signals of a market correction

By Holly Thompson.

With the U.S. stock markets reaching new highs last week, investors are even more nervous about the impending correction that inevitably needs to take place. But when? When will we see investor sentiment, [...]

Remarks on Money: How the Destruction of the Dollar Threatens the Global Economy — and What We Can Do about It by Steve Forbes and Elizabeth Ames

By Steve Hanke.

These remarks were delivered at a Cato Book Forum, June 19, 2014, Washington, D.C.

My big takeaway from Money (McGraw Hill, 2014) is that Steve Forbes is no James Dean. Forbes is a rebel with a cause. Free-markets [...]

Real Business Leaders Want to Save Capitalism

By Robert Reich.

A few weeks ago I was visited in my office by the chairman of one of the country’s biggest high-tech firms who wanted to talk about the causes and consequences of widening inequality and the shrinking middle class, [...]

Take a look at this chart, what do you see?

By Tim Price.

You may not be familiar with the Greek word pareidolia, but you’ve probably experienced it. Derived from the Greek for ‘faulty image’, pareidolia refers to the psychological phenomenon of seeing meaningful shapes where [...]

A Few Notes on Bonds

By David Merkel.

My comments this evening stem from a Bloomberg.com article entitled Bond Market Has $900 Billion Mom-and-Pop Problem When Rates Rise. A few excerpts with my comments:

It’s never been easier for individuals to enter [...]

If Public Education is Outsourced to Private Businesses: A Cautionary Take

By Alan J. Singer.

In some quarters in the United States, especially among Republicans, the supposed superiority of unregulated capitalist enterprise over government programs for the delivery of social services is a virtual [...]

Excess reserves and inflation risk: A model

By David Andolfatto.

===================================================================

Note: The following is an edited version of my original post. Thanks to Nick Edmonds for pointing out an inconsistency in my earlier analysis. Nick’s [...]

What Economic Recovery?

By Alan Caruba.

You have to know that the Obama administration has run out of excuses for destroying the U.S. economy when it starts to blame it on the weather.

According to the Commerce Department, the economy based on its Gross domestic [...]

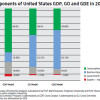

GO: J.M. Keynes Versus J.-B. Say

By Steve Hanke.

In late April of this year, the Bureau of Economic Analysis (BEA) at the U.S. Department of Commerce announced that it would start reporting a new data series as part of the U.S. national income accounts. In addition to [...]

Bitcoin has changed everything

By Michael Bach.

Its importance as an evolution in money and banking cannot be overstated. Notice I don’t use the word “revolution” here because I consider Bitcoin to be a complete “evolution” from the anachronistic money [...]