What Keynes has done to us

By Nelson Hultberg.

The essential economic problem we confront today is that our dominant Keynesian intellectuals have abandoned reality. They do not grasp what they have wrought with the mountainous loads of debt and malinvestment that are [...]

80:20 Piketty disregards Pareto, Zipf

By Josep Colomer.

Thomas Piketty’s best-selling Capital in the Twenty-First Century is rich and innovative in data, although the author’s management of some sources is now being discussed. Another matter is that his findings could [...]

Three Perspectives on Brazilian Growth Pessimism

By Otaviano Canuto.

It has become increasingly evident over the last two years that the growth engine of the Brazilian economy has run out of steam. Despite relative resilience during the global financial crisis and following [...]

Big Data Comes to the Farm

By Monty Guild.

Although the prospect seems far-fetched, the second-oldest profession is on the cusp of a technological revolution. Farmers have faced a long transition over the past three centuries in which their ancient art has become [...]

Four Tickets to Ride With VMS Ventures

By Richard Mills.

VMS Ventures TSX.V-VMS and Reed Lake Copper Mine partner Hudbay Minerals have reached what Hudbay defines as commercial production – 60 percent of planned production over a 90 day time period. Shouldn’t be [...]

Money market funds were a victim, not a cause, of the financial crisis

Peter J. Wallison.

Article Highlights

Money market funds were a victim, not a cause, of the financial crisisTweet This

Unless banks are allowed to establish ABCP conduits, the Treasury won’t seek to use taxpayer funds to protect [...]

About Those Forecasts of Eternally Rising Corporate Profits

By Charles Hugh.

If corporate profits decline, what will hold up the market’s lofty valuations other than the tapering flood of liquidity from the Federal Reserve?

I have often noted that profits of global U.S. corporations have [...]

Israel embraced by the global business community

By Yoram Ettinger.

1. The mega-billion dollar Chinese food conglomerate, Brightfood ($17bn annual sales) acquired 56% of the Israel-based Tnuvah – Israel’s largest food/dairy company – for $1.4bn, aiming to dramatically [...]

Does War Have a Future?

By Lawrence S. Wittner.

National officials certainly assume that war has a future. According to a report by the Stockholm International Peace Research Institute, world military expenditures totaled nearly $1.75 trillion [...]

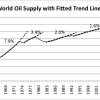

The Connection Between Oil Prices, Debt Levels, and Interest Rates

By Gail Tverberg.

If oil is “just another commodity,” then there shouldn’t be any connection between oil prices, debt levels, interest rates, and total rates of return. But there clearly is a connection.

On one hand, spikes [...]

Capital Controls Rolling Into High Gear Under FATCA

Capital Controls Rolling Into High Gear Under FATCA.

The traditional banking system was already bad enough but now, with banks around the world rushing to comply with the Foreign Account Tax Compliance Act (FATCA) it is beginning to reach [...]

Who Said The Hydra Would Take It Lying Down?

By Antal Fekete.

I have never appealed to the so-called conspiracy theories in trying to explain the strange world of fluctuations in the price of monetary metals. But neither have I ever said that the fiat-money Hydra will take [...]

University Presidents Are Laughing All the Way to the Bank While the People Who Work for Them Are on Food Stamps

By Lawrence S. Wittner.

Is economic inequality growing in American higher education?

A report just issued by the Institute for Policy Studies―The One Percent at State U―indicates that it is. Surveying public [...]

Credit Suisse Admits Guilt For Money Laundering

By Michael Bach and Jeff Berwick.

As Credit Suisse (CS) pled guilty for conspiring to aid US tax evasion and swallowed $2.6 billion in fines in federal court in Alexandria, Va., Eric Holder sensed the historic moment he [...]

On the Fall of the Rupiah and Suharto

By Steve Hanke.

On August 14, 1997, shortly after the Thai baht collapsed on July 2, Indonesia floated the rupiah. This prompted Stanley Fischer, Deputy Managing Director of the International Monetary Fund, to proclaim that [...]

Madness!

By Tim Price.

“Central bankers control the price of money and therefore indirectly influence every market in the world. Given this immense power, the ideal central banker would be humble, cautious and deferential to market signals. [...]

Deborah Weir market analysis

By Deborah Weir.

Headlines scream global unrest and hint at war. The stock market is weak and confidence indicators are poor. Don’t they know that war, as terrible as it is, stimulates the economy?

Look at the graphs of GDP during [...]

Raising Taxes on Corporations that Pay Their CEOs Royally and Treat Their Workers Like Serfs

By Robert Reich.

Until the 1980s, corporate CEOs were paid, on average, 30 times what their typical worker was paid. Since then, CEO pay has skyrocketed to 280 times the pay of a typical worker; in big companies, to 354 times.

Meanwhile, [...]

The Real State of the Economy–Not Obama’s Lies

By Alan Caruba.

My Father was a Certified Public Accountant and so is my older brother, now comfortably retired in Florida. I tell you this because I would be hard-pressed to balance my checkbook.

Even so, you do not have to be [...]

Chicago dances on the edge of a fiscal cliff

By Michael Bach.

It is the third largest city in the US with a population of 2,714,856 as of mid-2012. It is the economic engine of Illinois. If Chicago falls, especially into bankruptcy, then the entire state is likely to do so as well. [...]