Redacted version of the April 2014 FOMC Statement

By David Merkel.

March 2014

April 2014

Comments

Information received since the Federal Open Market Committee met in Januaryindicates that growth in economic activity slowed during the winter months, in part reflecting adverse [...]

China controls the Gold Price

By Julian Phillips.

In addition to the latest excellent study of the Chinese gold market by the World Gold Council, we have received other reports on the Chinese gold market that differ with the conclusions drawn by the World Gold Council. [...]

Curtailing Consolidation and Re-Invigorating Innovation

By David Dock Treece.

The past two centuries – since the Industrial Revolution hit its stride – have seen consolidation among American businesses at an ever-quickening pace, with the result that the US economy has stifled [...]

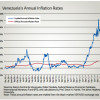

Measuring Misery around the World

By Steve H. Hanke.

The Great Recession grinds on. And as it does, politicians of all stripes ask, usually behind closed doors, “Just how miserable are our citizens?” The chattering classes offer a variety of opinions. As it turns out, [...]

No end to central bank meddling as ECB embraces ‘quantitative easing’, faulty logic

By Detlev Schlichter.

“Who can print money, will print money” is how my friend Patrick Barron put it succinctly the other day. This adage is worth remembering particularly for those periods when central bankers occasionally [...]

A New Cold War Means A New Record Price For This Precious Metal

By Michael Bach.

Palladium could be heading for a record. Here’s why:

Tensions in the Ukraine have turned investors’ attention towards precious metals. In times of political conflict, especially military, precious metals generally [...]

How The Fed Conducts War

By Berry Ferguson.

Aah! There they are. I was worried that the Plunge Protection Team (PPT, or, if one prefers, The Presidents Working Group on Financial Markets) had forgotten their job. The PPT exists so the Fed can drive stock [...]

Social Security, Treasury Stealing Every Last Penny From Americans

By Michael Bach.

All of a sudden the government lays claims to your savings. They can’t prove you owe them a dime, but you’re deprived due process. The legal bills become overwhelming, and so you let your money be stolen. You [...]

If You’re Big and Move Money, Watch Out

By Peter J. Wallison.

Since the financial crisis in 2008, central bankers and bank regulators world-wide have repeatedly called for controls on “shadow banking.” Federal Reserve officials, including former Chairman Ben [...]

The Distributional Games

By Robert B. Reich.

Every year I ask my class on “Wealth and Poverty” to play a simple game. I have them split up into pairs, and imagine I’m giving one of them $1,000. They can keep some of the money only on condition they reach [...]

Does the Gold Price reflect true gold Demand and Supply?

By Julian Phillips.

In short, no it doesn’t! We will look at why not, in this article.

The Gold Fix

Despite the furore surrounding the Gold Fix [unfairly, we believe] it is a singularly determined attempt amongst commodities [...]

France’s Valls Is No Clinton

By Steve Hanke.

President Francois Hollande has put in place a new French government led by Prime Minister Manual Valls. This maneuver has all the hallmarks of shuffling the deck chairs on the Titanic. Yes, one has the chilling feel [...]

Paying for Influence – Koch Brothers and George Soros

By Richard Larsen.

Judging from Senate Majority Leader Harry Reid’s nearly daily diatribes on the floor of the U.S. Senate, George W. Bush has been retired as the most despised villain, and the cause of all the evils that plague [...]

It’s in his (Political) Genes

By Richard Mills.

Japanese Prime Minister Shinzo Abe’s “Abenomics” goal was to end a long miserable decade and a half of deflation by kick starting the economy. This was going to happen because of massive yen creation. [...]

What the FSOC’s Prudential decision tells us about SIFI designation

By Peter J. Wallison.

Key points in this Outlook:

In September 2013, the Financial Stability Oversight Council (FSOC) designated Prudential Financial as a systemically important financial institution (SIFI); its rationale was perfunctory [...]

More Bread and Circuses

By Tim Price.

Editor’s note: We’re grateful to Tim Price of PFP Group for this article. PFP has made this document available for your general information.

“Lower borrowing and a smaller deficit mean less debt.”

– George Osborne, [...]

Adios Fannie Pref

By Bruce Krasting.

I first wrote about (and got invested in) the Fannie and Freddie Preferred stock back in the summer of 2009, Link. As of today, the last of those shares have been sold. For those who followed my path, an explanation [...]

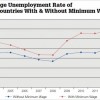

Let the Data Speak: The Truth Behind Minimum Wage Laws

By Steve Hanke.

President Obama set the chattering classes abuzz after his recent unilateral announcement to raise the minimum wage for newly hired Federal contract workers. During his State of the Union address in January, he [...]

Russia Threatens To Abandon The U.S. Dollar And Start Dumping U.S. Debt

By Michael Snyder.

The Obama administration and the hotheads in Congress are threatening to hit Russia with “economic sanctions” for moving troops into Crimea. Yes, those sanctions would sting a little bit, but what our [...]

Why the ECB Should Buy American

By Jeffrey Frankel.

CAMBRIDGE – The European Central Bank needs to ease monetary policy further. Eurozone-wide inflation, at 0.8%, is below the target of “close to 2%,” and unemployment in most countries remains high. Under [...]