Lots of Money, No Deals available

By Mark Borkowski.

At this time, there is more money in the system than anyone can imagine. There is a shortage of companies to acquire, or good projects to invest in. The theory that the baby boomers were selling their companies [...]

Monetary Policies Misunderstood

By Steve H Hanke.

Ever since the U.S. Federal Reserve (Fed) began to consider raising the federal funds rate, which it eventually did in December 2015, a cottage industry has grown up around taper talk. Will the Fed raise [...]

Saudis’ Double-Standards for Iran Oil Freeze & Fantasy of Increase in Oil Production

By Peyman Jonoubi.

Having found that its plan to freeze Iranian oil is not effective, Saudi Arabia directed Doha talks to failure. 18 oil producing states get together in Doha, Qatar, on April 17 to stabilize oil production [...]

A Chinese Revolution in Gold & Silver Markets in Shanghai

By Julian Phillips.

The Yuan Gold Fix

Is now established and running effectively. It provides two daily Benchmark prices before London opens.

To date it has blended China’s gold price to London and New York, seamlessly. To date China’ [...]

USD: Return of the King

By Shane Obata.

Falling oil prices, China growth fears, submerging markets, Brexit and Italian banks. All of those risks have one thing in common: They have not derailed the US economy. Despite concerns about a recession, it [...]

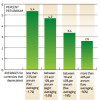

What’s Killing U.S. Growth

By Steve H. Hanke.

On April 6th, the Wall Street Journal published an editorial that merits careful examination: “Jack Lew’s Political Economy”. The Journal correctly points out that the Obama administration’s meddling [...]

Liberty In The USA

By barry ferguson.

There was an incident that happened in February of this year that needs to be explored. A group of Christian musicians were touring in a foreign country to raise money for an orphanage and a hospital. They [...]

One Year After: Freddie Gray and ‘Structural Statism’

By Steve H. Hanke and Stephen J.K. Walters.

When Freddie Gray was born in 1989, Baltimore hosted 787,000 residents and 445,000 jobs. By the time his fatal injuries in police custody provoked riots last April, the city’s population [...]

Mitch McConnell will stay the course on the Garland nomination

By Peter J. Wallison.

The media drumbeat on a replacement for Justice Scalia continues unabated. The nomination of Merrick Garland has been hailed as a brilliant Obama move to increase pressure on GOP leader Mitch [...]

Obama’s parting ‘gift’ to the financial industry

By Peter J. Wallison.

A White House meeting which took place in early March could have wide-ranging implications for the future of U.S. financial markets. Although regulators are supposed to be independent of the president and his [...]

US voters sick and tired of ‘free-rider’ world

By Leon Hadar.

You want to capture the mood of the American people on the eve of the 2016 presidential election? Well, imagine that the Washington Monument – the 555-foot (169m) marble obelisk towering over Washington, DC, [...]

What is the COMEX Futures & Options market really all about?

By Julian D.W. Phillips.

Let’s take a deep look into COMEX in this article that describes COMEX today.

All of us follow COMEX in New York and assess the ‘net speculative long position’ there, so as to see the actual weight of opinion [...]

The Nightmare Scenario Facing Iraq – and the US

By Riyadh Mohammed.

Just as the Iraqi government announced the beginning of the operations to liberate Mosul, the country’s second largest city, Iraq’s internal political turmoil threatens to reverse what has been achieved against [...]

Shadow Banks Are Not a Source of Systemic Risk

By Peter J. Wallison.

Last week, my friend Eugene Ludwig wrote an article on American Banker headlined: “Unregulated Shadow Banks Are a Ticking Time Bomb.” The gist of the article was that there are risks building [...]

The FCIC Misled The American Public

By Peter J. Wallison.

Everyone agrees that the 2008 financial crisis was the result of a “mortgage meltdown,” the default of an unprecedented number of subprime and Alt-A mortgages (often called nontraditional mortgages, [...]

Time For Candidates to Address Debt, Spending, and Economy

By Richard Larsen.

The discourse on the presidential race has devolved to a point that the most pressing issues seem totally lost in the verbal brawls between candidates. The economic threats and risks to the republic should be the centerpiece [...]

Why the MetLife Case Bears Watching Well Beyond Wall Street

By Peter J. Wallison.

Judge Rosemary Collyer

A ruling against federal regulators could mean a brake on the wild growth of the administrative state.

Federal district Judge Rosemary Collyer sent a shock through [...]

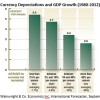

Currency Wars, the Devaluation Delusion

By Steve H. Hanke.

In 2010, Brazil’s Finance Minister, Guido Mantega, coined the phrase “currency war” when he complained about the “cheap” Chinese renminbi (RMB). Mantega claimed this gave China an unfair trade advantage. [...]

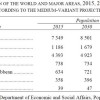

The No Fresh Water Planet

By Richard Mills.

As a general rule, the most successful man in life is the man who has the best information

Our planet is 70 percent covered in ocean – 98% of the world’s water is in the oceans. Which makes 98% of the world’s [...]

Currency Wars, the Devaluation Delusion

By Steve H Hanke.

In 2010, Brazil’s Finance Minister, Guido Mantega, coined the phrase “currency war” when he complained about the “cheap” Chinese renminbi (RMB). Mantega claimed this gave China an unfair trade advantage. [...]