Dr. Salman Ghouri and Mian Aneesuddin.

During the past 50 years global oil demand increased from 30.8 million barrels per day (MMBD) in 1965 to 92.03 MMBD in 2014 – an increase of 61.28 MMBD. In contrast, global oil production increased by 56.87 MMBD during the same period (BP-Statistical Energy Review June 2015). That is on an average annual growth in demand and supply of 1.22 and 1.15 MMBD respectively. Energy Information Administration (EIA) predicts global oil demand to increase to 113.1 MMBD in 2035. Likewise global natural gas demand is projected to increase to 4760 BCM in 2035 as compared to 3394 BCM in 2014[3].

In order to meet the projected demand for global oil, natural gas and other sources of energy, International Energy Agency (IEA) estimated that during 2012-2035 the world would be needing cumulative investment of $48 trillion during now and 2035, consisting of around $40 trillion in energy supply and the remainder in energy efficiency. The main components of energy supply investment are the $23 trillion in fossil fuel extraction, transport and oil refining; almost $10 trillion in power generation, of which low-carbon technologies – renewables ($6 trillion) and nuclear ($1 trillion)1 – account for almost three-quarters, and a further $7 trillion in transmission and distribution. Less than half of the $40 trillion investment in energy supply goes to meet growth in demand, the larger share is required to offset declining production from existing oil and gas fields and to replace power plants and other assets that reach the end of their productive life. Compensating for output declines absorbs more than 80% of upstream oil and gas spending. The fundamental question is how and from where the oil and gas industry will generate this level of investment year after year especially during the regime of lower oil prices?

Market Fundamentals

History has taught us that sustained higher oil prices negatively affect the demand, but encourages supply side (assuming other factors remain constant). The most important determinant of the level of exploration activity by international oil companies (IOCs) is the current and most recent past oil prices. The initial response of the industry to increase in oil prices may not immediately lead to an upsurge in exploration activity, but possibly a reappraisal of discoveries made in mature regions deemed uneconomic under lower price scenarios. Therefore, exploration activities in new acreage especially high-risk-high-cost basins are expected to increase after a year or two in response to higher oil prices especially if IOC’s strongly view that pattern of high oil price will continue in the future. Higher oil prices improves profitability of oil and gas industry and therefore they are willing to invest in high cost unexplored basins (new frontier – deep offshore) in search of sizeable oil fields. In addition high oil prices also induces investments in energy efficiency, conservation, backstop fuel supplies from unconventional crude oil from tar/tight sands, oil shale, gas to liquid (GTL), coal to liquid (CTL)[4], and other renewable sources of energy – thus reducing the pressure on oil demand in the long run. For example, recently, the sustained higher oil prices substantially encouraged shale oil/gas development, particularly in the USA, which is complemented by innovative technological advancements in horizontal drilling and hydraulic fracturing. Likewise, the world has also witnessed rapid growth in renewable sources of energy; however, it is not a threat to fossil fuels due to its marginal share in total energy mix. Persistent higher oil prices also adversely affected the global economy – slowing down oil demand. Therefore, eventually market fundamentals push the oil prices downward. The recent memories of 2007/2008 and later during 2011-2014 a period of higher oil prices followed by plunging oil prices during 2nd half of 2008 and 2014/2015 are still afresh.

In contrast to higher oil price regime, lower oil price environment reduces the oil and gas industry profitability and therefore, they immediately take cost cutting measures including cutting back exploration activities. Recently, we have witnessed that it is difficult for most of the OPEC members to balance their budget given the low oil prices, and are forced to deplete sovereign funds (or foreign exchange reserves). That is, in the regime of softer oil price environment it will be even difficult for the industry to sustain current level of oil production that requires continuous investment in work over, side-tracking, recompletion of wells in different formation, secondary recovery, and EOR and what to speak of new investment in finding and developing new reserves. A sustained lower oil price environment reduce profitability, cutting back in exploration activities, however, increases oil demand, depleting oil inventories and therefore eventually market fundamental will push the oil prices and converge to its long-term equilibrium.

Implications of sustained higher or lower oil prices

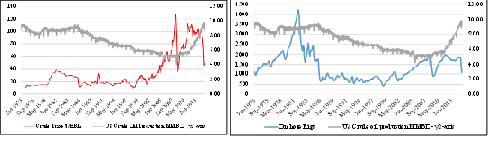

The sustained higher oil prices always encourage exploration activities with some lags. Figure-1 & 2 illustrate the historical relationship between US rig counts onshore/offshore against oil prices. The visual inspection clearly demonstrates that there is indeed a positive correlation between drilling activities and oil prices though drilling activities increase/decrease with some lags. To test this relationship, we have used January 1974 to March 2015 monthly data. Number of rig count onshore and offshore are separately run against the oil prices. The models were suffering from serious autocorrelation and therefore we have used autoregressive moving average (ARMA) of order one. The onshore rig count is more responsive to changes in oil prices than the offshore. As expected the initial response to changes in oil prices was marginal, however with the passage of each month the response got stronger and stronger. It took 24 months for onshore when a full impact is realized with 0.86 percent increase/decrease in exploration activities in response to one percent increase/decrease in oil prices. For offshore, the response to changes in oil prices for the first five months were negative and statistically insignificant. Thereafter the response was positive but remain statistically insignificant. It took 17 months before we got statistically significant response to changes in oil prices. However, after passage of 24 months the full impact was less than half that of onshore 0.41 percent increase/decrease in drilling activities as a result of one percent increase/decrease in oil prices. The difference between the responses to onshore and offshore drilling is due to magnitude of investment, difficulty, and time required to mobilization/demobilization of drilling rigs. Offshore requires huge capital investment as compared to onshore and therefore more time is required for planning and analyzing before making final investment decision. In case of US shale oil drilling, the response to changes in oil prices is shorter duration of about 5-6 months.

The lag for example could be due to initially revisiting resources that were deem uneconomic during the regime of lower oil prices or a lag is involved in acquiring new lease/concessions, carrying out seismic surveys etc. Higher anticipated prices will encourage exploration activities, however, it is not like turning the switch on or off rather it requires a number of years before the full impact is fully realized. In a similar manner when oil prices plunge, exploration activities did not die off instantaneously due to contractual commitments, or in the middle of drilling, drilling rig is hired for a number of year(s) etc. Therefore, the trends depict a lag before the impact of increase/decrease in oil prices is fully realized. A similar trend could be witnessed when relationship between oil prices and oil production are analyzed (Figures-3& 4). The response of oil production to changes in oil prices took longer adjustment times than the drilling rig count.

Figure-1: Correlation between US Onshore Rig & Prices

Figure-2:Correlation between US Offshore Rig & Prices

Figure-3:Correlation between Oil Prices & Oil Production

Figure-4:Correlation between Onshore Rig & Production

Figures-5 & 6 depict the best fitted graph for both onshore and offshore based on best estimated model. Onshore drilling is more responsive and requires less number of months to increase/decrease in drilling activities in response to changes in oil prices. Whilst offshore drilling activities are less sensitive, erratic and require more time to respond to changes in oil prices.

Both the models fit quite well as more than 97% of the variations are explained by the given explanatory variables. The higher sustained oil prices results in acceleration of exploration activities leading to more oil and gas discoveries and enhanced production. Whilst lower oil prices over extended period of time not only constrained industry profitability but also hampered the required investment in exploration and development activities. What we have learned from history is that neither higher nor lower oil prices are sustainable over an extended period of time and world would continue to live in cyclical uncertain environment. That is, lower oil prices over extended period of time will choke the supply side but continue encouraging oil demand that in turn will gradually push the oil prices – another episode of higher oil price will be followed. Though some episodes are short lived while others could hold back for a number of months depending on global economic situation and inventories level. The cyclical movement in oil prices will ensure that neither high nor low oil prices will continue to stay forever – giving a hope of oil and gas industry to continuously progress and also allows to develop new-state-of-the-art-technology. It appears that such episodic oil price regime is necessary condition in balancing the global supply/demand.

Figure-5: Onshore drilling best fit

Figure-6: Offshore drilling best fit

Note: the above article has been published in International Energy Investments as well as placed on my linkedin

If you have any comments or share some thought that would add value to readers are welcome.