Greece: Down and Probably Out

By Steve H. Hanke.

Led by the charismatic Alexis Tsipras, the Syriza party took office in Athens on January 26th. The most prominent member of the new Prime Minister’s cabinet is Yanis Varoufakis, the Finance Minister. [...]

Ukraine: The World’s Second-Highest Inflation

By Steve H. Hanke.

Venezuela has the dubious honor of registering the world’s highest inflation rate. According to my estimate, the annual implied inflation rate in Venezuela is 252%.

The only other country in which this rate [...]

Market update

By Paul Nolte.

Wall Street is singing “It’s always better when we’re together”. From the Royal Dutch Shell buying BG Group to Mylan and

Perrigo hooking up, there have been over 120 mergers announced already this year [...]

Why Janet Yellen Should Start Smoking Cigars

By Mark Nestmann.

Every three months, the mainstream media participate in a ridiculous charade: interpreting the quarterly announcements from the Federal Reserve Board of Governors.

The first time I paid much attention [...]

Quo Vadis Greece? Rupture or agreement with European creditors

By Georgios X. Protopapas.

The view from Athens

The negotiations between the Greek government and Greece’s European creditors have become unpredictable, while the Greek economy remains stagnant and the state desperately [...]

Lifting Off, Sooner or Later

By David Andolfatto.

From Barron’s yesterday we have this lovely headline: Two Fed Presidents Contradict Each Other on Same Day.

From the dovish corner, Charles Evans, president of the Chicago Fed, suggested that the Fed [...]

On the Great Inflation Canard

By Steve Hanke.

Charles W. Calomiris and Peter Ireland, two distinguished economists and friends, wrote an edifying piece in The Wall Street Journal on 19 February 2015. That said, their article contains a great inflation [...]

The European conundrum

By Aditya Pandey.

Syriza’s win in Greece underscored the fact that Greeks are in no mood to drink the poison of austerity concocted by their Eurozone creditors. Years of austerity measures have proved futile. A quarter [...]

Involuntary labor market choices?

By David Andolfatto.

My pal Roger Farmer has a lot of good ideas, but he doesn’t always use the best language to express them. In a recent post, for example, Roger asserts the following.

Participation is a voluntary [...]

Is this the end of the Euro?

By Mark Nestmann.

With the US dollar hitting multiyear highs against other global currencies almost daily, Americans are in a sweet spot for making international investments. Your US dollars will buy a lot more rubles, [...]

The Monetary Approach Reigns Supreme

By Steve Hanke.

We are still in the grip of the Great Recession. Economic growth remains anemic and below its trend rate in most parts of the world. And what’s more, this state of subdued economic activity has been with [...]

China: Hot Money In, Now Out

By Steve H. Hanke.

For some years, hot money flowed in, adding massively to China’s foreign reserve stockpile. Speculators borrowed cheaply in U.S. dollars and bought yuan-denominated assets in anticipation of an ever-appreciating [...]

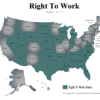

Economic Benefits Of Right To Work

By Richard Larsen.

This week Wisconsin became the 25th state in the union to pass and sign into law so-called “right to work” legislation. Despite the pejorative light oftentimes associated with right to Work (RTW) laws, [...]

Is This the First Nail in the Coffin of Citizenship-Based Taxation?

By Mark Nestmann.

US citizens who expatriate – those who give up their citizenship and passport – don’t get a lot of respect.

Take Facebook co-founder Eduardo Saverin, for instance. When the Brazilian-born Saverin gave [...]

Part 1: One dozen reasons why the average person underperforms in investing

By David Merkel.

Brian Lund recently put up a post called 5 Reasons You Deserve to Lose Every Penny in the Stock Market. Though I don’t endorse everything in his article, I think it is worth a read. I’m going to tackle [...]

What Happens When Big Brother “Privatizes” Debt Collection?

By Mark Nestmann.

It’s bad enough to have the IRS or another government agency after you. But when Uncle Sam – or even a state or local government – hires a collection agency to chase after you, things can go downhill [...]

China’s copper con

By Richard Mills

If you needed upwards of 50ml tonnes of copper over the next 5 years, and had very little production of your own, what would you do?

I’m thinking you’d manipulate the market like crazy trying to [...]

Why This Greek Tragedy Could Mean Global Disaster

By Mark Nestmann.

One of the assumptions of the eurozone – those 19 countries in Europe that use the euro as their national currencies – is that if any country left the zone, economic disaster would follow in its [...]

Latin American Corporate Finance: Is There a Dark Corner?

By Otaviano Canuto.

Since last year there has been much talk of possible financial stress stemming from increased debt leverage in non-financial corporates of emerging markets economies. A recent study has brought to light some [...]

The Financial Planning Fable

By Ben Treece.

For decades, financial professionals have made a living by selling retirement plans to clients. These professionals claim that if you use their services that they will assess your risk tolerance, retirement [...]