By Mark Nestmann.

With the US dollar hitting multiyear highs against other global currencies almost daily, Americans are in a sweet spot for making international investments. Your US dollars will buy a lot more rubles, yen, and Canadian dollars than they would a year, or even a month, ago.

But it’s the dollar’s rise against the euro, the official currency for 19 EU countries, that has the world’s attention. On March 13, the euro hit an intraday low of 1.046, its lowest level against the dollar in 12 years. It’s bounced back a bit since, but indeed, the euro has fallen nearly 25% against the greenback since July 2014.

Economic pundits attribute the collapse in the euro’s value to the actions of the European Central Bank (ECB). The ECB has embarked on a €1.1 trillion effort to revitalize eurozone economies that never really recovered from the global financial collapse of 2007-2008. It has announced it will buy €60 billion of eurozone government bonds monthly through September 2016.

The objective of this exercise is to encourage banks to lend more money. Banks are supposed to make more loans. The idea is that banks take €60 billion and buy new assets to replace the bonds they sold to the ECB. That in turn is supposed to cause stock prices to rise and interest rates to fall, boosting investment in the eurozone.

Where will the ECB get the money? It will do what central banks do best: create the money out of thin air through “quantitative easing” (QE). The ECB and other central banks have run out of ways to stimulate global economies. If QE doesn’t work, there’s no backup plan – just more QE.

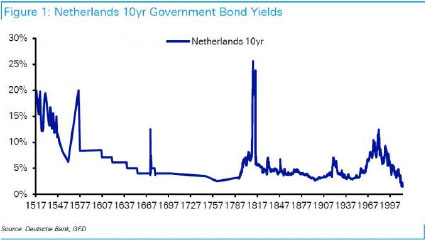

And there are plenty of indications that it won’t work. Even before the ECB climbed onto the QE bandwagon, interest rates in some eurozone countries were already at 500-year lows. Here’s a chart, for instance, of Dutch interest rates since 1517. As you can see, they’ve never been lower.

Indeed, the ECB itself started charging banks that hoard cash at the central bank negative interest rates last June (currently -0.2%). This policy punishes banks that have strict lending standards and encourages them to lend money.

The fall of the euro spells big opportunities for Americans who have most of their savings in dollars. Without doing anything at all, your US dollars will buy a lot more euro-denominated assets than they could only a few months ago. For instance, that apartment in Vienna I’ve been eyeing for years is now 25% less expensive in dollar terms than it was only a few months ago.

But along with these opportunities come risks. And not just the obvious ones.

The obvious risk, of course, is that the euro could fall further. While negative interest rates may give banks an incentive to lend money, and consumers and businesses an incentive to borrow, it makes the currency less attractive to investors. For that reason, I think the fall in the euro could go further. Indeed, the euro’s all-time low against the US dollar is just above 82 cents, a level it reached in 2000. That’s nearly 25% below its current levels.

A less-obvious risk is if the country you decide to invest in decides to leave the euro. What if I wanted to buy an apartment in Athens, for instance, rather than Vienna?

At first glance, buying property in Athens sounds like a no-brainer. Prices for the average residential property are down more than 40% in euro terms since 2008. Combined with the fall in the value of the euro, that means investors with greenbacks to burn can buy property in Athens at a 50% savings from what they could only a few years ago.

But if Greece were to abandon the euro, the government would need to resurrect the drachma – the currency Greece used prior to joining the euro – overnight. It’s unlikely anyone would be excited at the prospect of buying drachma-denominated bonds, so the Greek government would have to offer sky-high interest rates to pay civil servants, finance social benefits, and defend its borders. Some economists think that the value of the “new” drachma could fall 40% or more in a matter of days.

The prospect of a “Grexit” (Greek euro exit) is real, as I explained in this essay. And not only Greece – Spain, Italy, and Portugal all have fiscal problems only marginally less severe than those of Greece. All of these countries would face the same dilemma as Greece if they were forced to revert to pre-euro pesetas, lira, or escudos.

That’s why I’m not in a hurry to buy any assets in these countries. I think that despite the fall of the euro against the dollar, assets in the countries on the southern periphery of the eurozone could get a lot cheaper in the years – and possibly months – ahead.

There’s an even less-obvious risk as well. What happens if not just sick economies like Greece pull out – or are forced out – of the euro, but relatively healthy ones like Germany do so as well? After all, German taxpayers are tired of footing the bill to pay (among other outrages) for Greek civil servants to retire at an average age of 53. What would happen if Germany abandons the euro and reverts back to the Deutsche mark?

In that event, the exact opposite effect would probably occur: The value of the Deutsche mark would soar as investors flock to it seeking a safe currency haven. That’s why if I invest anything more in the eurozone than I already have, I’ll be looking to put it into stronger economies like Germany and Austria.

If the euro does collapse, and the countries now comprising the eurozone resurrect their own currencies, EU policymakers will view it as a colossal defeat for their dreams of a centrally planned currency. Indeed, the loss of confidence could be so shattering that it encourages Europe’s power elites to do something that is now unthinkable: revert not just to pre-euro currencies, but to gold.

From the time of ancient Egypt until the early 20th century, gold was the backbone of the global economy and the ultimate store of value. It’s not a particularly attractive asset from a central planner’s perspective, which is why it’s gotten short shrift during the last century. After all, you can’t devalue it, and you can’t create it out of thin air. But once the ECB’s QE program meets its demise along with the euro, gold could well be the only real option left.